Back in 2020, Dubai International Financial Centre (DIFC) had introduced the DIFC Employee Workplace Saving plan or, DEWS in short. The scheme has since replaced the old End-of-Service Benefit (EOSB) system in the DIFC.

Now, the plan has been running for more than four years, and it’s time to take stock. Below are the key highlights based on the annual financial statements for the YE 2020 – 2023 brought to you by Pensions Monitor:

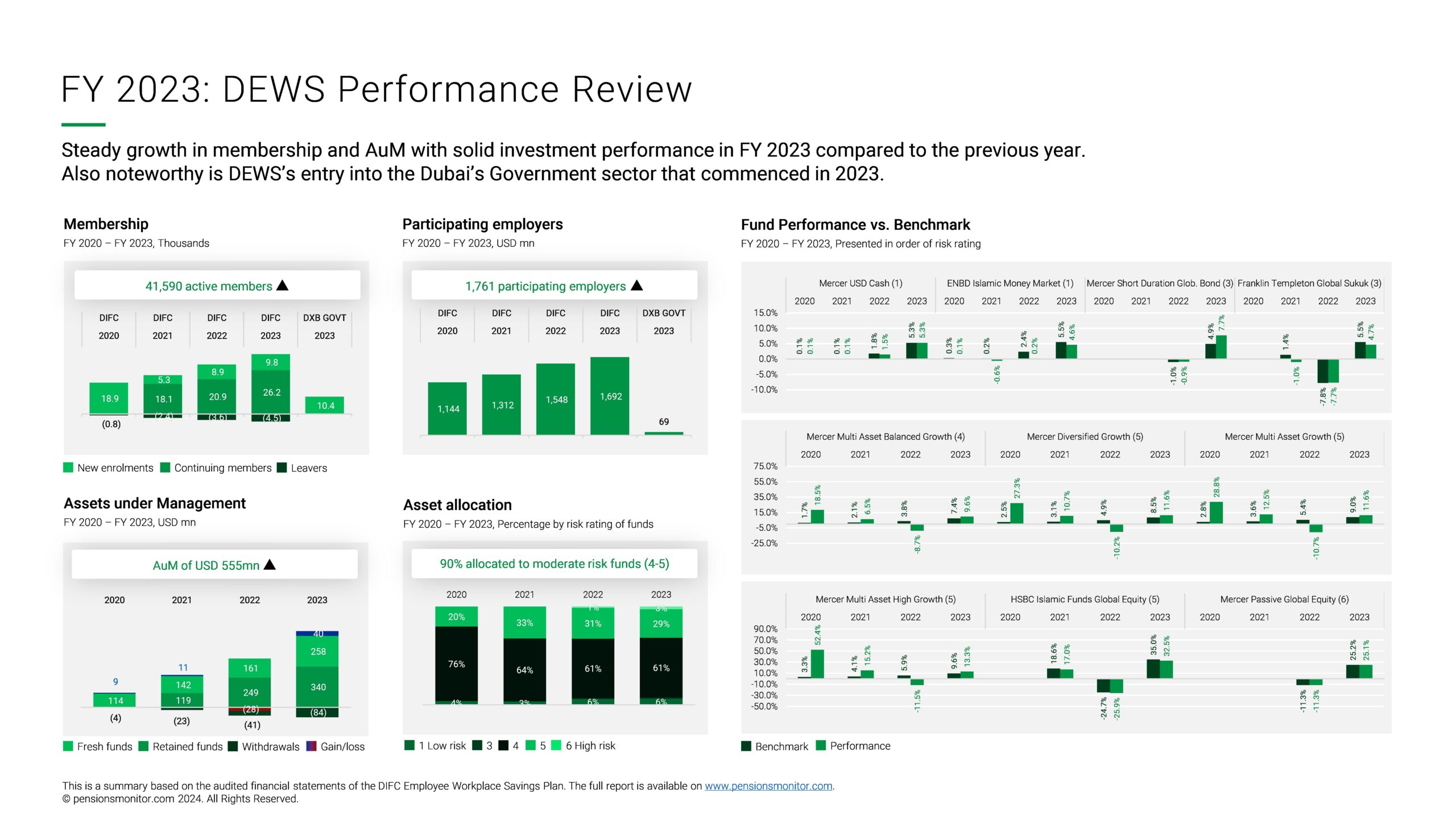

Membership

From 18,057 members that enrolled during the first year of operation in 2020, the number of active members from DIFC participating employers reached 31,468 at YE 2023 with new enrolments averaging at ~40% per annum and leavers (full withdrawals) averaging at ~15% per annum.

Additionally, the plan was made available to the expatriate employees of the Dubai Government entities from January 2023, increasing the number of enrolled members by a further 10,122 in 2023.

This takes the total enrolment to 41,590 at YE 2023.

Assets under Management (AuM)

Total AuM has increased from USD 119mn at YE 2020 to USD 555mn at YE 2023 factored by the relatively high retention of funds averaging at ~90%, investments gains generated on retained funds each year and fresh contributions that were particularly high during 2023 owing to Dubai Government employees, net of withdrawals.

Looking at the results of the last four years, DEWS clearly demonstrates how the End-of-Service Saving plan is superior to the legacy EOSB by generating considerable assets over a period of time that employees can call their own.

That said, the financial results of DEWS also clearly depict how such saving plans are exposed to market volatility as observed in 2022 (see chart below) producing substantial losses of USD 28mn.

Such exposure to market volatility is of course correlated to how assets were allocated by employees across the funds on offer by DEWS.

Asset allocation

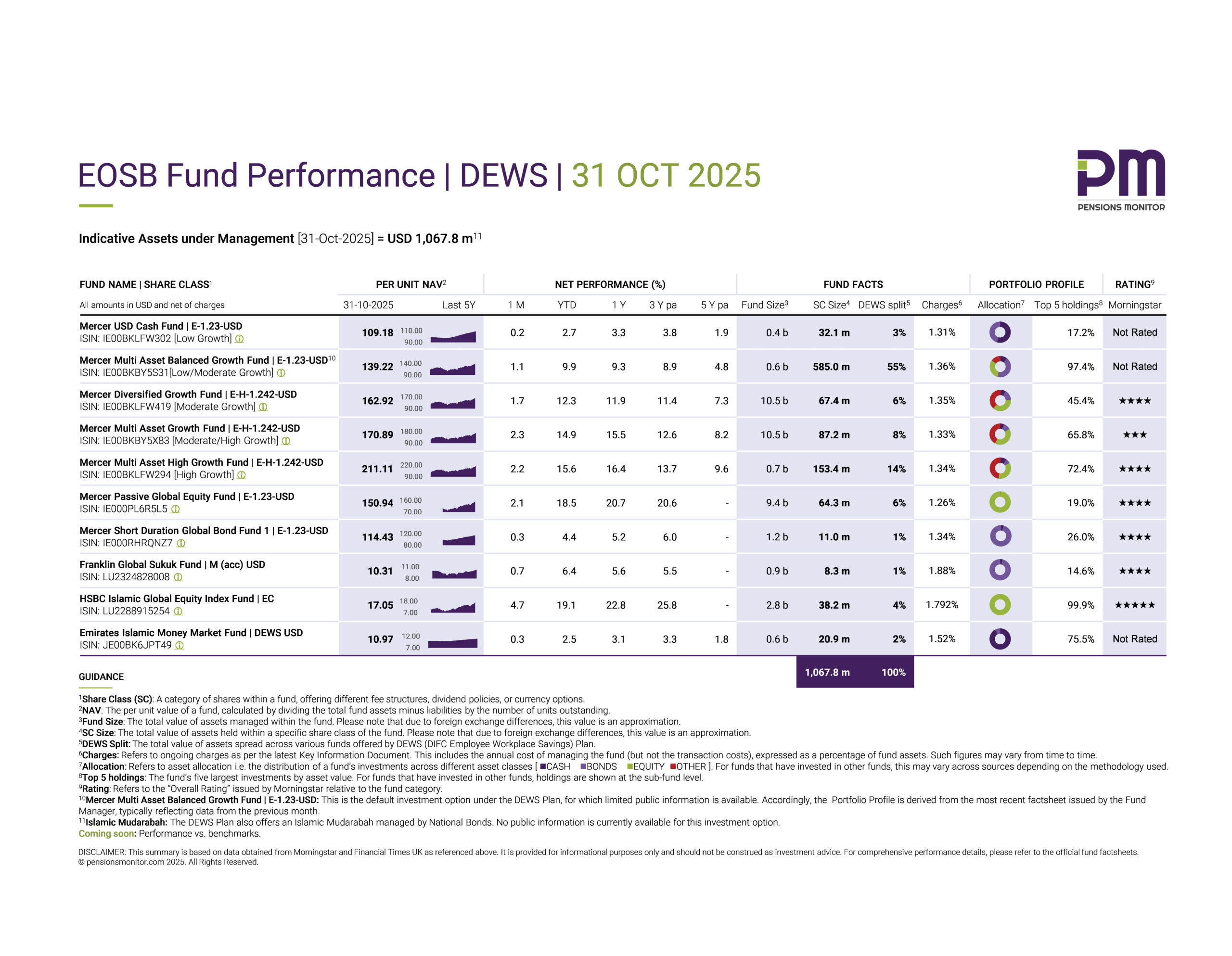

DEWS started off with six funds in 2020 and now has on offer ten fund choices for members, seven of which are managed by Mercer, the investment advisor for the plan while the remaining three funds are Islamic Sharia’h funds managed by ENBD (money markets fund), Franklin Templeton (global sukuk) and HSBC (global equities).

The ten funds carry varying risks rated from 1-7 with 1 representing the conversative/low risk funds such as the Mercer USD Cash Fund and 7 representing the aggressive/high risk funds. It is interesting to note that ~90% of funds have been consistently invested in moderate risk funds rated between 4-5 while low-risk cash funds account for 5% of the AuM.

So which funds are driving growth of AuM?

Fund Performance

When comparing funds, one must compare them against suitable benchmarks and not directly with each other. The reason is that the 10 funds on offer carry different levels of risk.

For instance, the ‘cash’ option is relatively risk-free (however, yielding a small profit). On the other hand, equity funds are more volatile, but when conditions are good (like in 2023) risky funds can generate a significant return.

Since 2023 was a relatively good year, in nearly all instances the DEWS funds have out-performed benchmarks. The lowest performer was the Islamic Money Market fund achieving a return of 4.63% while the highest return was scored by HSBC’s Islamic Global Equity fund (32.5%).

In contrast, in a challenging year like 2022, all the funds underperformed led by HSBC’s Islamic Global Equity fund at -29.5% while the highest return was generated by Mercer’s USD Cash Fund at a modest 1.5%.

Charges

The yields mentioned above are gross of the Trustee (Equiom), Administrator (Zurich Workplace Solutions), investment management and advisor fees (Mercer). Based on the financial statements, these sum up to 1.23% and has remained so since the first year of operation. In other words, the effective fund performance achieved is lower, as the charges eat into the profit.

Further in the Annual Report we can gleam that the “triumvirate” of Equiom, Zurich and Mercer achieved combined revenues of USD 5.4mn during 2023, the lion’s share of which goes to Zurich. As the AuM continues to grow y-o-y, the revenue of these service providers as well will increase. While one needs to recognize that there is an awful lot of work that goes into managing such saving schemes and the beneficiaries thereof that require call centre support, IT programs, investment monitoring, and so on, by way of comparison in the UK there is a legal cap on charges for employee saving schemes set at 0.75% of AuM. Although, to be fair, the AuM volumes are significantly larger in the UK.

Customer service

While this aspect will be monitored more diligently going forward, based on anecdotal feedback, beneficiaries are reported to be generally satisfied apart from some frustrations voiced about the IT platform.

In summary, as the first savings plan in the UAE, DEWS has by and large sent out a success message to the country with a steady growth in membership and AuM and its noteworthy entry into the Dubai’s government sector.

Following closely behind is MoHRE’s new alternative End-of-Service Savings (EoSS) scheme that will likely be rolled out as a nation-wide mandate in due course. Given the differences between the two schemes it remains to be seen if DEWS will eventually have to align with Cabinet Resolution 96, more so because DEWS services only a small fraction of UAE’s working population.

In the interim, it is interesting is to see what the new providers of DEWS are set to offer. Remember, Sukoon had obtained a license for DEWS last year, and Hayah reportedly also intends to offer a solution for DEWS.

Follow Pensions Monitor for the latest news and developments on EoSS in the UAE.

You can also sign up to receive the updates in your mailbox.