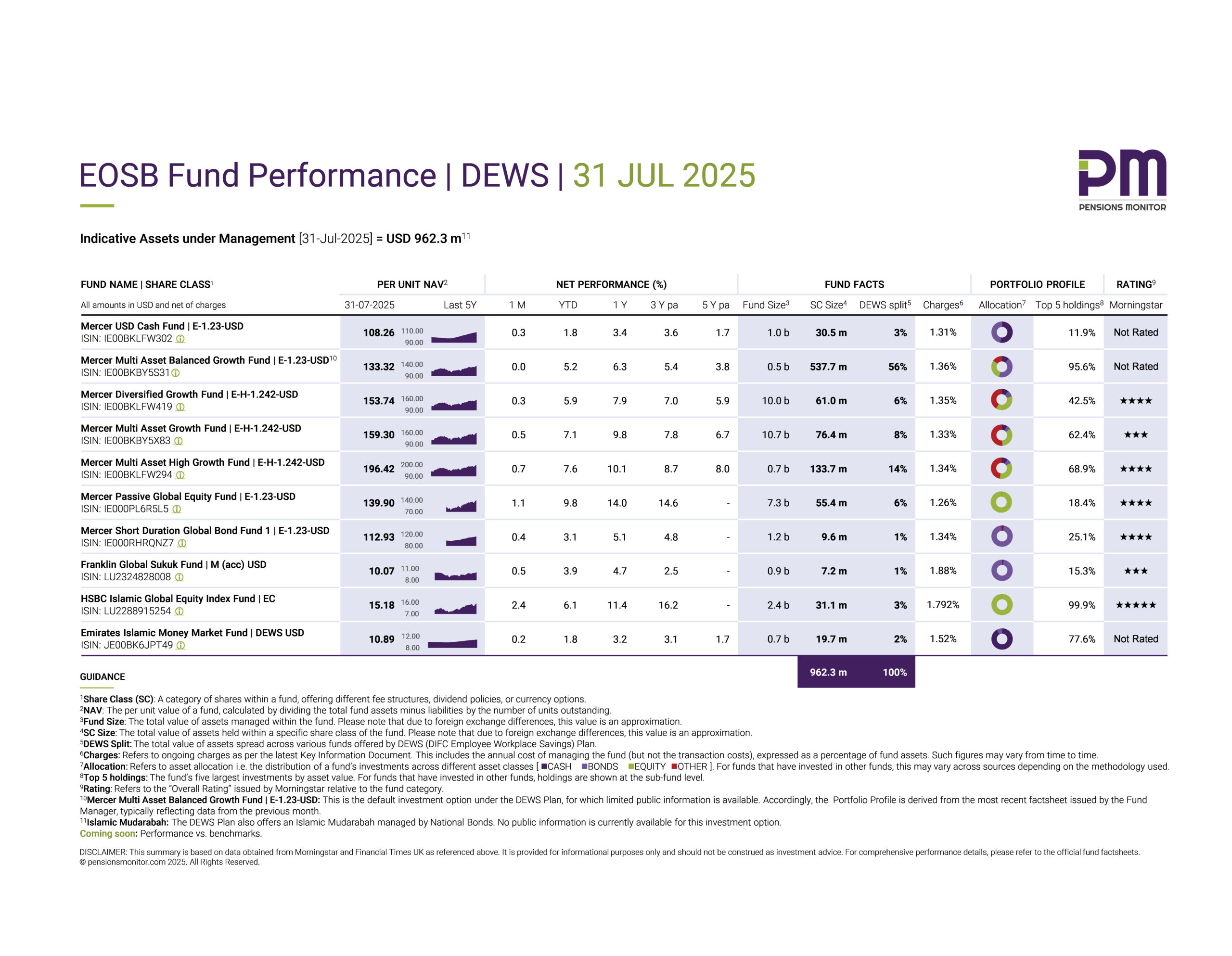

EOSB Fund Performance | DEWS | 31 JUL 2025

After a solid first half of the year, July brought little excitement for DEWS fund performance. Returns for the month were modest across the board, with most funds holding their ground or delivering small gains. Notably, the default fund, a balanced option selected by the majority of plan members, ended the month flat.

For those new to the topic, DEWS is one of two official End-of-Service Benefits (EOSB) Savings plans in the DIFC. Every month, Pensions Monitor tracks how these EOSB funds perform, so employers and employees can better understand where their EOSB money is going.

👉 Click here to download the dashboard.

What happened in July 2025?

The DEWS funds are invested across global financial markets, but U.S. assets make up a large share of those investments. Let’s turn to the U.S. for a minute.

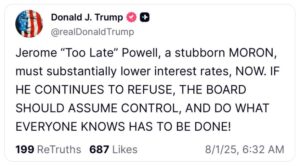

Recently, Donald Trump made headlines again with a typical dramatic post directed at Federal Reserve Chair, Jerome Powell calling him “Too Late”. (And for greater emphasis, he used bold fonts and a selection of words too).

Why such a post, and what did he mean?

We know that interest rates are set by the Central Banks – in this case, the U.S. Federal Reserve – to achieve certain policy objectives, such as to help control inflation or stimulate the economy. Any movement – up or down – directly affects the prices of both stocks and bonds. In fact, sometimes it’s not the movement itself, but the expectation, that impacts markets. (But that’s a topic for another time).

Trump’s tweet suggested that the Fed should be cutting rates more aggressively which, historically, tends to boost stock prices and make bond yields fall. In fact, the European Central bank (ECB) has been steadily lowering the main interest rate, whilst the US Fed has been more reluctant and has held interest rates steady again in July, showing no rush to start easing.

How has the Fed’s decision affected DEWS?

Despite no rate cut from the Fed, U.S. stocks gained in July, with the S&P 500 up 2.2% and the Nasdaq 100 also logging strong performance with a gain of 2.4%, buoyed by strong earnings from tech giants and surprisingly, strong consumer spending. It was enough to keep U.S. equities in positive territory and helped DEWS equity-based funds deliver solid returns in July.

The HSBC Islamic Global Equity Index Fund gained 2.4% in July, pushing its year-to-date (YTD) return to 6.1% and it’s conventional sibling, the Mercer Passive Global Equity Fund, notched a 1.1% gain for the month and an impressive 9.8% YTD.

The Fed’s decision to hold rates had a more direct impact on bonds.When rates stay high or are expected to remain high for longer, bond yields stay elevated. And since bond prices move in the opposite direction to yields, this can put pressure on returns, especially for longer-term bonds.

Short-duration bonds, however, are less sensitive to interest rate movements. So, the Mercer Short Duration Global Bond Fund and the Franklin Global Sukuk Fund still gained 0.4% and 0.5% in July, and 3.1% and 3.9% YTD, respectively.

On the conservative end, money market and cash equivalent funds provided stable, positive returns with the Mercer USD Cash Fund and Emirates Islamic Money Market Fund both delivering 1.8% YTD. While modest, these returns exceed many traditional savings alternatives and provide essential portfolio stability.

What should DEWS savers watch out for next?

As we move into the third quarter of the year, DEWS savers must keep an eye on inflation trends, the Fed’s policy decisions, and how corporate earnings play out. These will affect both bond yields and equity markets and by extension, your DEWS fund returns.

In short, stay informed. While low returns may feel underwhelming, in a cautious period like this third quarter, stability can be a strength. And diversified portfolios like those offered in DEWS are built to weather exactly these kinds of market conditions.

Coming up next

Let’s see how rival scheme GO SAVER performed in July in our next article. Sign up for our free newsletter today, so you don’t miss out!

Disclosure Statement Issued in accordance with the UAE Securities and Commodities Authority’s Finfluencer Regulation. Article: EOSB Fund Performance | DEWS | 31 Jul 2025 Author: Nisha Braganza Capacity: Natural person SCA Finfluencer Registration: 012 Data sources: Morningstar, Financial Times UK and factsheets, cited in the Article Data date: 31 Jul 2025 Price time reference: NAVs used reflect end-of-day pricing as of “Data date” Publication date: 05 Aug 2025 Target audience: Employers/employees tracking EOSB Savings Schemes in the UAE Validity: 30-day period from "Data date", unless updated Nature of content The Article contains a dashboard (factual data and performance data) and accompanying commentary. Factual data includes Net Asset Value (NAV) per share, fund size, share class size, asset allocation, charges, top holdings, and ratings. These are sourced from “Data sources” and has not been modified. Performance data is calculated using a proprietary time-weighted return model, based on daily NAV movements. The model does not involve forward-looking assumptions or forecasts. Commentary is the author’s opinions and interpretations of the data and does not constitute financial advice or a recommendation to buy, sell, or invest in any fund. Comparisons between funds are based on publicly available information. These do not represent endorsements and have been drafted impartially, without bias or exaggeration. Limitations While reasonable care has been taken to ensure objectivity, balance, and clarity, the Author has relied on “Data sources” without independent verification. Accordingly, the Author does not accept responsibility for the accuracy or completeness of “Data sources”. Past performance is not indicative of future results and commentary does not represent expected outcomes. Previous Articles on the subject are available on www.pensionsmonitor.com. Conflicts of interest The Author has not received any compensation from the respective fund issuers, nor holds investments in any of the funds mentioned. No party involved in this publication has a commercial relationship with the respective fund issuers or EOSB Scheme managers. Investment advice disclaimer Investors are advised to consult with a financial advisor licensed by the UAE Securities and Commodities Authority or other relevant authority, before making investment decisions.