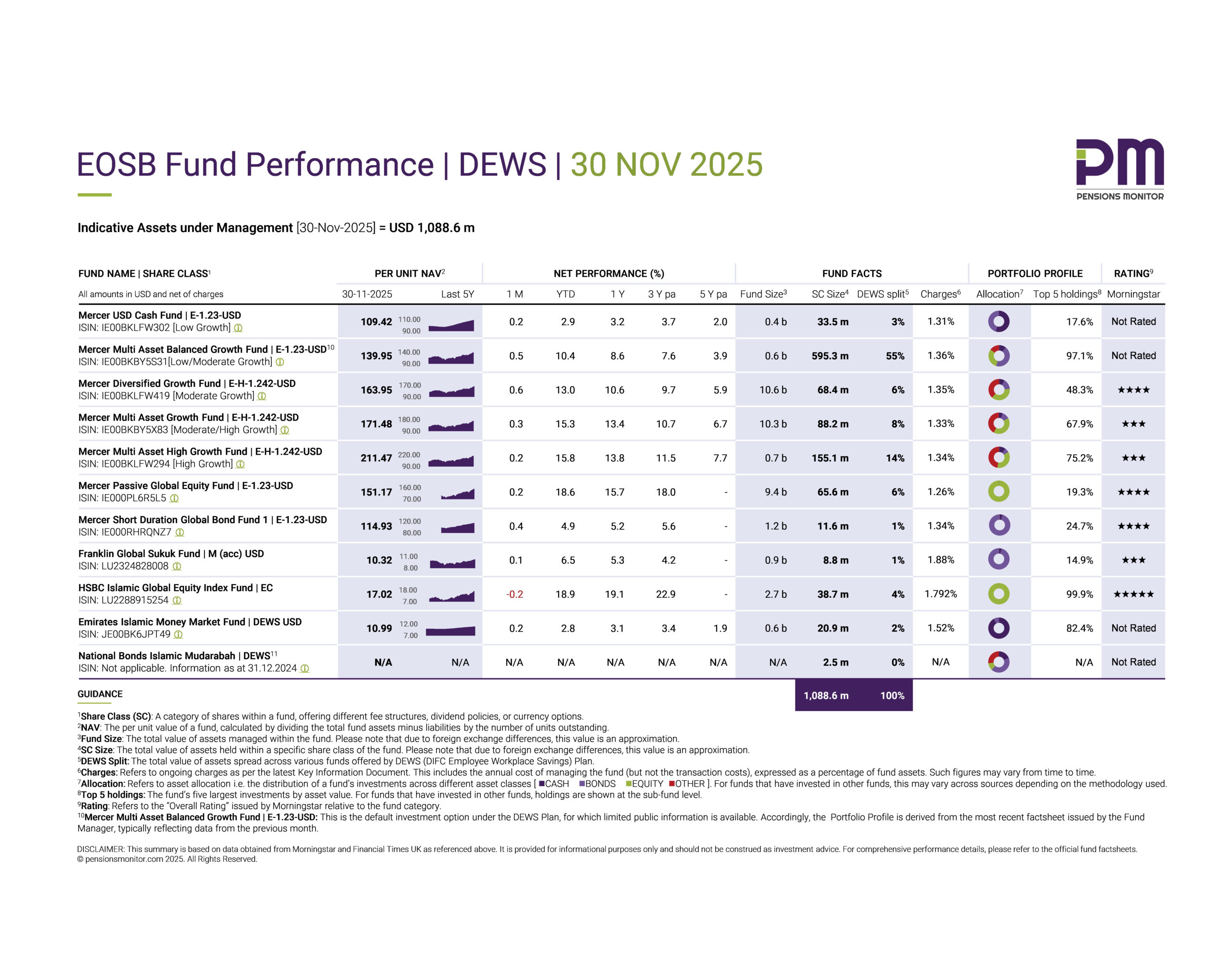

EOSB Fund Performance | DEWS | 31 MAY 2025

May was a strong month for DEWS fund performance. All funds, with one exception, are now showing positive year-to-date (YTD) returns.

👉 Click here to download the dashboard.

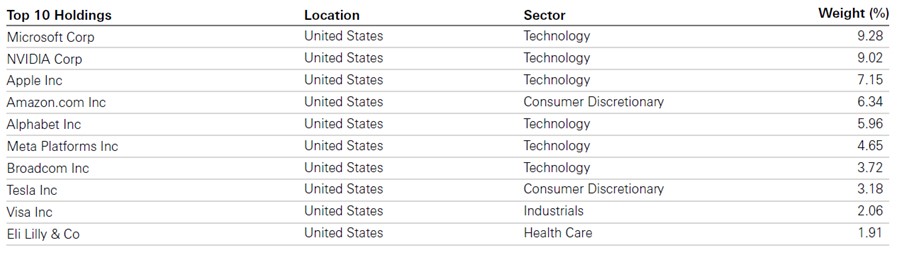

The exception is the HSBC Islamic Global Equity Index Fund, which, despite a strong recovery in May, remains down YTD. What might be the reasons? A look into the fund’s top holdings shows a relatively heavy focus on US tech stocks like Apple, Microsoft, NVIDIA, Amazon, Tesla, etc. and some of these stocks have not performed well this year, for instance, Apple is down 18%, Alphabet (Google) 9%, Tesla 9%. However, these declines should be seen in the context of the large gains they have made in previous periods.

HSBC Islamic Global Equity Index Fund as at 31 May 2025

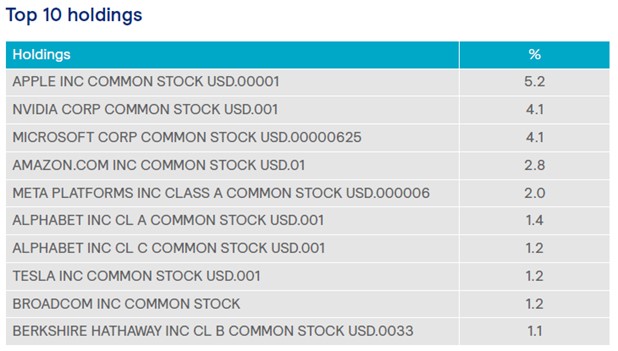

By contrast, the Mercer Passive Global Equity Fund returned 5.9% in May, bringing its YTD performance to 4.1%. Interestingly, this fund also holds many of the same US tech names. However, it seems to have benefited from broader diversification (1,376 holdings excluding cash) compared to the HSBC fund which appears relatively concentrated (100 holdings excluding cash with higher weightings in its top holdings, suggesting a more concentrated allocation approach).

Mercer Passive Global Equity Fund as at 30 April 2025

Another driver is Mercer’s better global diversification with ~13% allocated to European equities, compared to ~8% for the HSBC fund. This is important insofar that the EUR has appreciated against the USD by over 10% this year, boosting the return (in USD) of the European equities.

Furthermore, the HSBC fund carries higher ongoing charges at 1.792%, compared to the Mercer Passive Global Equity Fund at 1.26%, which also contributes to the difference in net performance shown in the dashboard.

But despite the difference in their recent performance, it is worth noting the HSBC Islamic Global Equity Index Fund carries a five-star rating from Morningstar (as of May 2025). This goes to show that short-term returns is just one of many other factors to be considered when evaluating funds.

What about the remaining funds?

We will dive deeper into the other funds in future articles. For now, it’s fair to say that the YTD return across the DEWS fund range turned broadly positive. Equity funds have performed well, bond-based funds have delivered steady returns, and money market funds remain stable as expected.

Of course, fund performance remains closely tied to broader macroeconomic and geopolitical developments. In recent weeks, we have seen how stock markets react quickly to political signals by shedding value promptly following the announcement of new US trade tariffs, and rebounding just as quickly when those tariffs were postponed/annulled. Let’s remember that the trade tariff situation between the US and Europe, and between the US and China, is still unresolved and so, further stock market volatility can be expected.

Disclosure Statement Issued in accordance with the UAE Securities and Commodities Authority’s Finfluencer Regulation. Article: EOSB Fund Performance | DEWS | 31 May 2025 Author: Nisha Braganza Capacity: Natural person SCA Finfluencer Registration: 012 Data sources: Morningstar, Financial Times UK and factsheets, cited in the Article Data date: 31 May 2025 Price time reference: NAVs used reflect end-of-day pricing as of “Data date” Publication date: 16 June 2025 Target audience: Employers/employees tracking EOSB Savings Schemes in the UAE Validity: 30-day period from "Data date", unless updated Nature of content The Article contains a dashboard (factual data and performance data) and accompanying commentary. Factual data includes Net Asset Value (NAV) per share, fund size, share class size, asset allocation, charges, top holdings, and ratings. These are sourced from “Data sources” and has not been modified. Performance data is calculated using a proprietary time-weighted return model, based on daily NAV movements. The model does not involve forward-looking assumptions or forecasts. Commentary is the author’s opinions and interpretations of the data and does not constitute financial advice or a recommendation to buy, sell, or invest in any fund. Comparisons between funds are based on publicly available information. These do not represent endorsements and have been drafted impartially, without bias or exaggeration. Limitations While reasonable care has been taken to ensure objectivity, balance, and clarity, the Author has relied on “Data sources” without independent verification. Accordingly, the Author does not accept responsibility for the accuracy or completeness of “Data sources”. Past performance is not indicative of future results and commentary does not represent expected outcomes. Previous Articles on the subject are available on www.pensionsmonitor.com. Conflicts of interest The Author has not received any compensation from the respective fund issuers, nor holds investments in any of the funds mentioned. No party involved in this publication has a commercial relationship with the respective fund issuers or EOSB Scheme managers. Investment advice disclaimer Investors are advised to consult with a financial advisor licensed by the UAE Securities and Commodities Authority or other relevant authority, before making investment decisions.