Pensions Monitor rolls out monthly dashboards

As of today, the UAE’s official End-of-Service Benefits (EOSB) Savings Scheme includes 11 approved funds and within the Dubai International Financial Center (DIFC), DEWS offers 11 investment options, and GO SAVER adds another 16.

With a growing list of options—and more providers expected—we thought it was time for a simple, bird’s eye view of all schemes.

With Pensions Monitor’s EOSB Fund Performance dashboards, you will find all fund performance information in one place, presented in a clear, consistent, and easy-to-understand format.

Please note that our EOSB Fund Performance dashboards are based on public information, which is appropriately cited. The dashboards are provided for informational use only and should not be construed as investment advice. For detailed fund performance, please refer to the official factsheets.

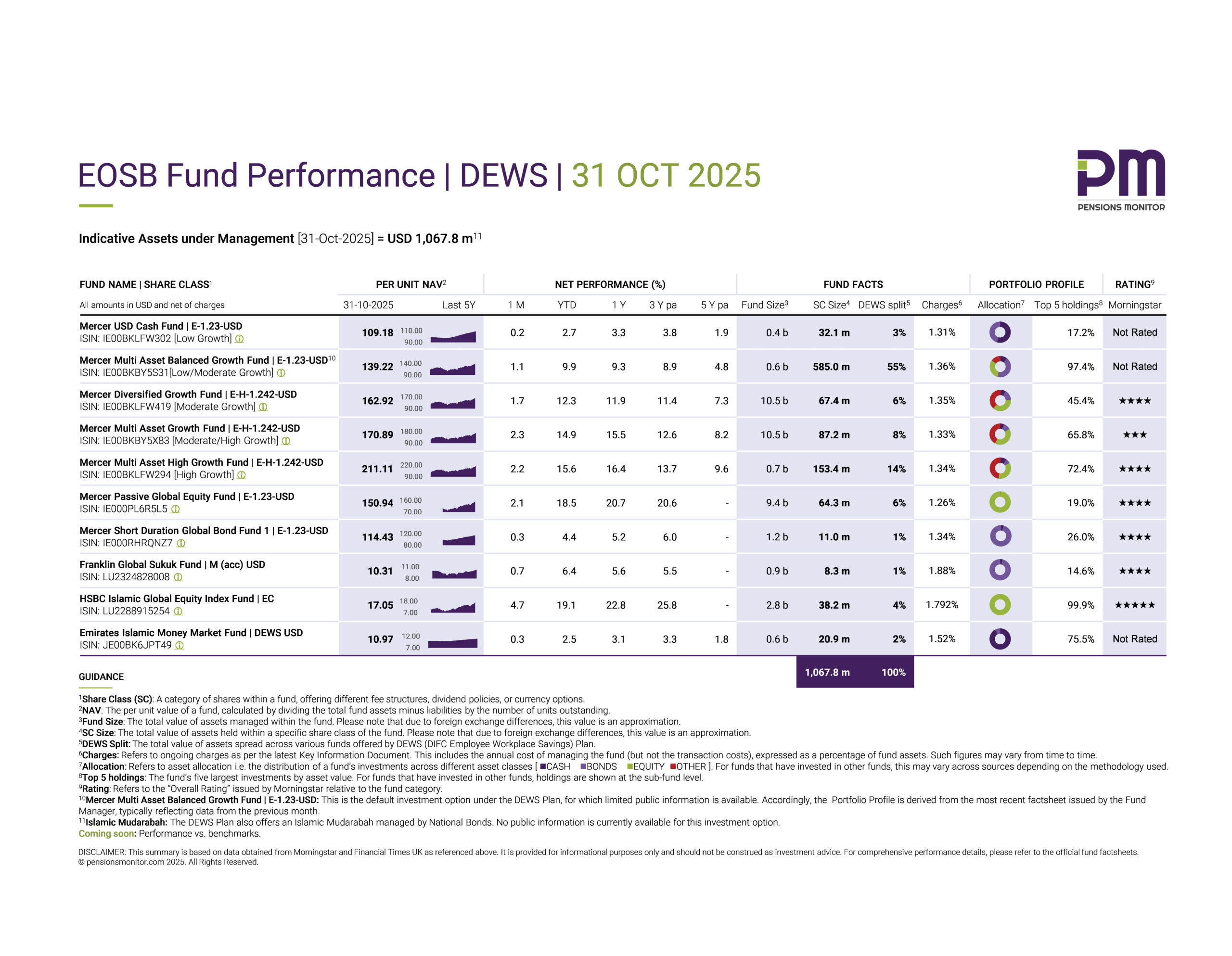

We’re starting with DEWS, the first official EOSB Savings Scheme launched in 2020 for the DIFC. The dashboard is available for download below.

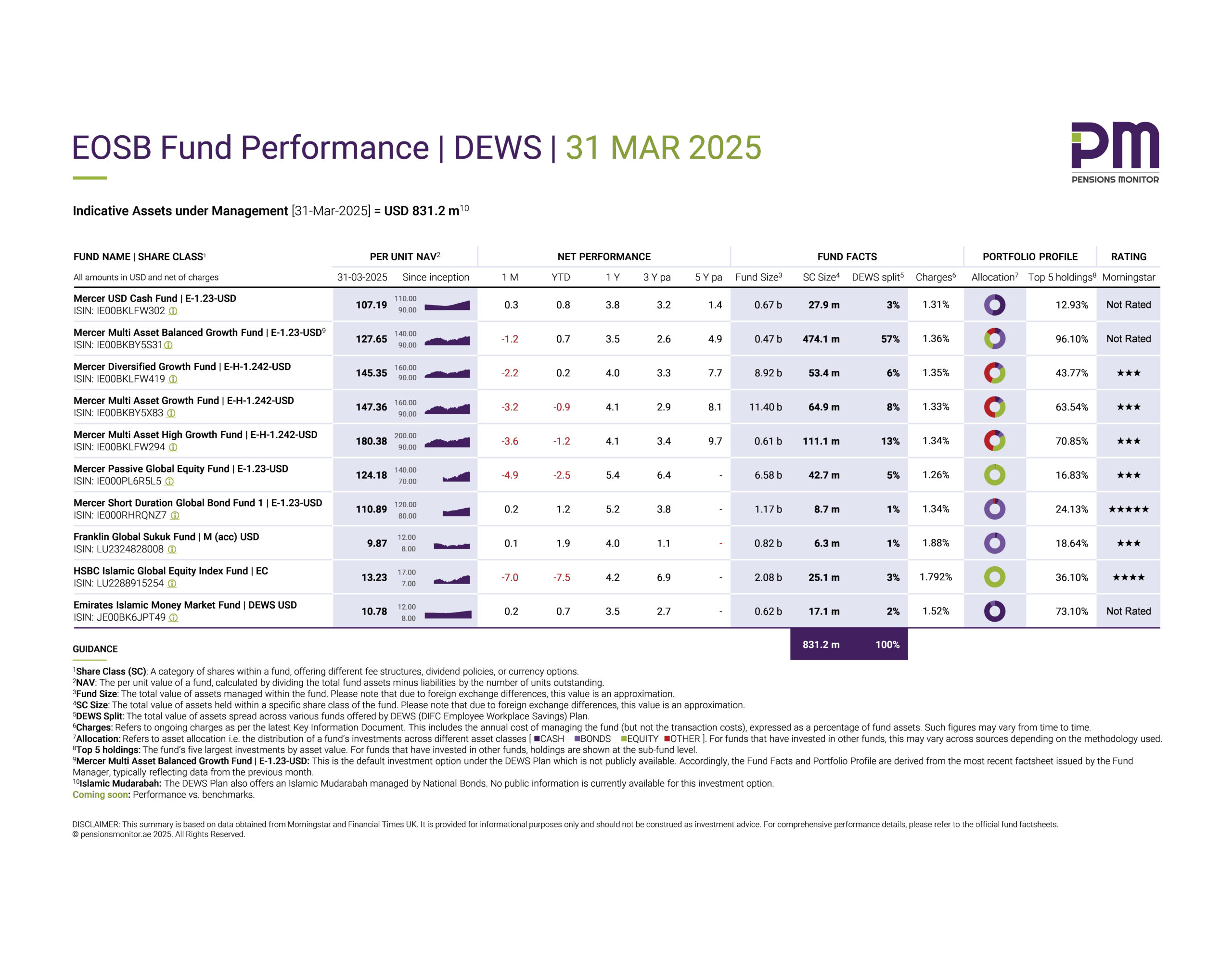

EOSB Fund Performance | DEWS | 31 March 2025

It’s fair to say that Q1 2025 has been a tough one for investors – and that’s before President Trump introduced his barrage of global tariffs. In a way, the first quarter performance is already starting to feel like “old news” in the light of the recent stock market convulsions.

Still, it’s worth stepping back to review how DEWS funds performed over the first quarter.

What happened in Q1 2025?

Equities suffered the most, so funds with a large equity component saw negative returns i.e., lost value:

- HSBC Islamic Global Equity Index Fund: -7.5%

- Mercer Passive Global Equity Fund: -2.5%

- Mercer Multi-Asset High Growth Fund: -1.2%

- Mercer Multi-Asset Growth Fund: -0.9%

Bond and cash-focused funds held up better:

- Franklin Global Sukuk Fund: +1.9%

- Mercer Short Duration Global Bond Fund: +1.2%

So, what now?

With markets still rattled from recent events, it’s natural to wonder what the right move is. While Pensions Monitor does not offer investment advice, here’s some context we think might help:

- Take the long view: EOSB workplace savings grow over the long term. These are not short-term investments or opportunities to time the market. If you are within say 8 years of retirement age, then you should consider taking Financial Planning advice.

- Don’t panic: It is not uncommon for investors to lose out if they panic. While the current malaise is not strictly comparable, during COVID, markets lost and gained around USD 15–20 trillion in just a few weeks from the peak in February 2020 to the trough in March 2020. The subsequent recovery was nothing but spectacular, with the S&P 500 index reaching pre-pandemic levels in less than half a year, and eventually climbing to dizzying heights by the end of 2024.

- “Dollar-cost averaging”: Regular monthly savings mean you are, right now, buying the dip.

Know your risk appetite

If Q1 taught us anything, it’s this: the right fund for you depends on your comfort with risk.

- Do you prefer high returns, but can accept that sometimes this is a wild ride, with painful periods of losses? Then Equity-heavy funds might suit you.

- Do you prefer stability, and can accept that the overall long term investment return is modest? Then bonds (respectively sukuk) or cash funds may be a better fit.

Ultimately, choosing the right fund is about matching it to your comfort with risk, not chasing the latest headlines.

Click here to download: PM_EOSB Fund Performance_DEWS_31.03.2025

Found this useful?

We’d love to hear what you think! If you have any feedback, suggestions, or questions, drop us a line at info@pensionsmonitor.com.

If this dashboard helped you better understand EOSB savings, please do share it. It might help others as well.

Our next dashboard will feature GO SAVER, the second official DIFC scheme, launched earlier this year.

Sign up for our free newsletter, so you don’t miss it!