People buy life insurance mainly for two reasons: Protection in the case of death or disability (obviously) and for investment purposes. Hence the life insurance industry has designed products (policies) in response to these needs. Some policies provide protection only (e.g., term insurance) and at the other end of the spectrum there are pure investment products with various combinations in between.

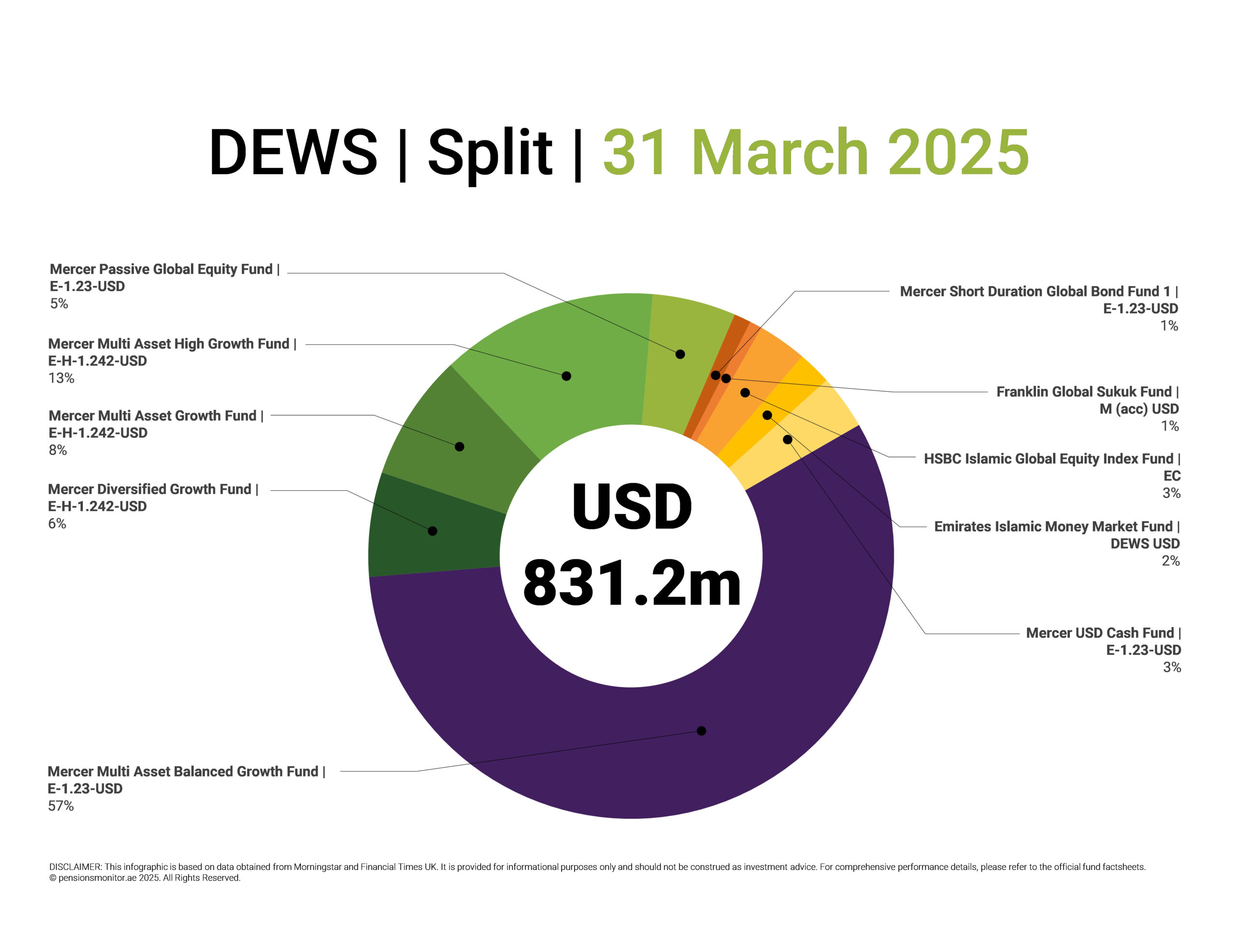

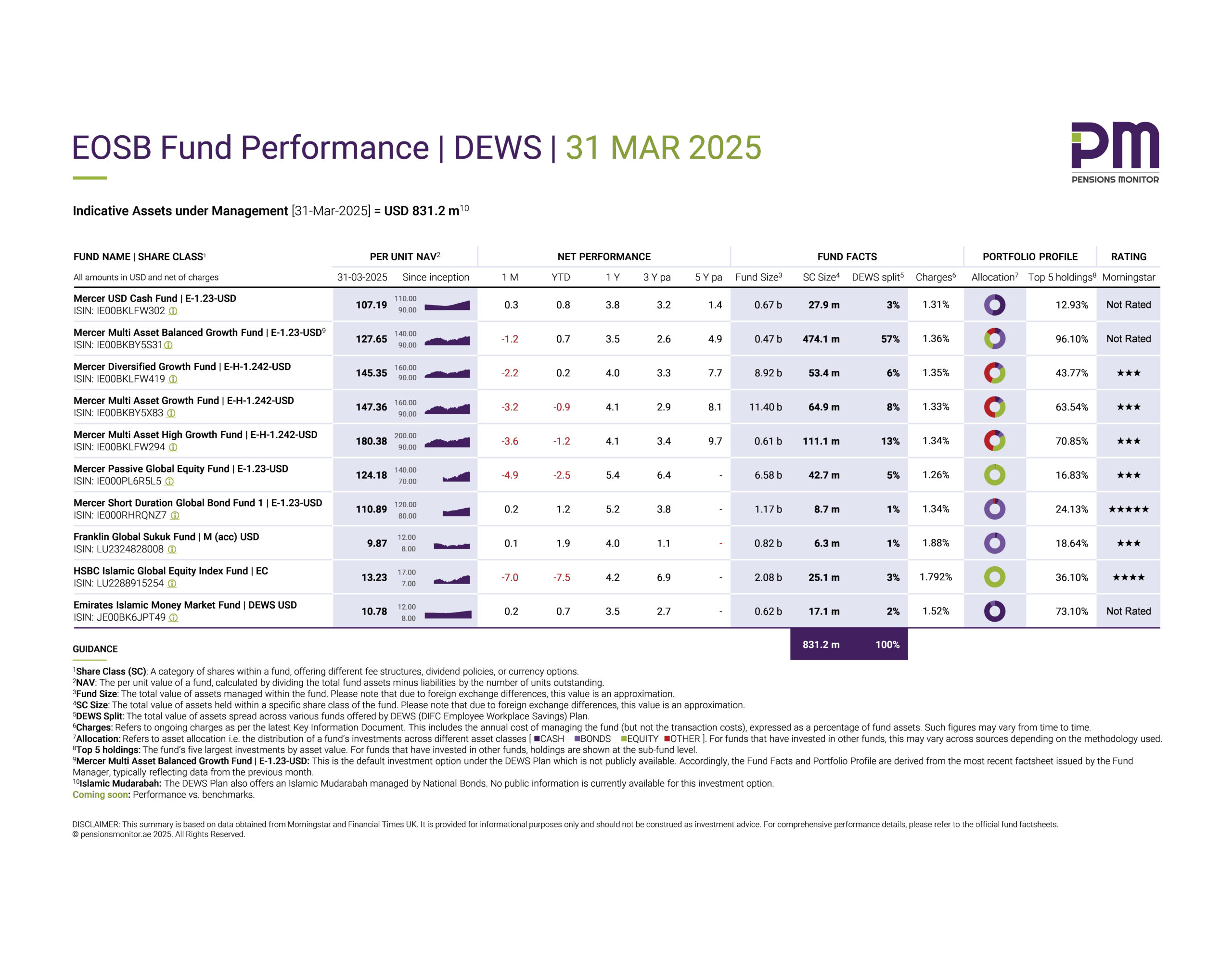

Now, with the introduction of the new End-of-Service Savings (EoSS) scheme, every employee in the UAE will sooner or later have easy access to investments via their employer. While specific product propositions are yet to be announced, it is safe to assume that the system will make available various investment funds – some with lower risk, some Shariah-compliant and others with medium/high risk – into which employees can allocate their savings.

EoSS also allows for employees to make voluntary contributions (capped at 25% of annual income), over and above the compulsory employer contributions. Voluntary contributions will also be automatically deducted from payroll and invested as desired by employees. In other words, it’s a straight forward and simple process. Except for restrictions pertaining to unskilled workers, EoSS allows skilled labour to freely allocate their savings across approved funds at their own risk. As these monies are voluntarily invested, there are no restrictions in terms of withdrawals and savings can be retained in the system even following termination of employment.

EoSS also extends the same investment access to self-employed individuals, independent business owners, expatriate employees working for government agencies, institutions, and affiliated businesses as well as national employees of the public and private sectors, provided that their employers continue to pay contributions to the General Authority for Pensions and Social Security in accordance with the applicable legislation.

In short, Cabinet Resolution 96 paves the way for an easy-to-access, easy-to-use savings platform.

This is in stark contrast to how life insurance policies are currently sold where insurance agents work on prospects, explain the (often quite complicated) products, and the (often complex) policy conditions, and eventually, after many client meetings, may clinch the deal. This lengthy sales process is eventually reflected in the (often hidden) product charges which can be substantial.

On the other hand, given the economies of scale, EoSS products will in all likelihood be relatively cheaper for employees and offer more transparency, a sense of security through local supervision and an ease-of-use due to the automatic payroll deduction mechanism. We can expect total charges to be around 1% of AuM, which is substantially lower than the typical long-term life insurance savings plans with their sales commissions, surrender charges, and AuM charges.

As such, employees with disposable income wishing to save further will be confronted with two choices: Invest easily and economically into funds offered by EoSS in which they will already have savings through employment, or go down the arduous route of discussing the details of a life insurance/investment policy with an insurance adviser.

Though still early days, it is likely that EoSS plans will outdo the life insurance industry in the UAE offering flexibility, transparency, a sense of security and overall better value. If so, this would be a second battering for the life insurance industry in the UAE following BOD 49/2019 that slashed commission rates, extended claw-back period to five years, and introduced a mandatory 30 day free-look period in favour of beneficiary protection. Since then, life premiums have decreased by 30% reaching AED 6.7bn in FY 2023 from AED 9.5bn in FY 2018. It may well be that the life insurance industry in the UAE will take another battering, this time from the new End-of-Service Savings products.

Pensions Monitor is tracking the latest developments on EoSS in the UAE. Sign up to receive updates straight to your mailbox.