In our previous articles we featured some startups that have appeared on the scene, including FinFlx, Aurem and Equevu. All of them offer some sort of investment product, linked to End-of-Service Benefits that is managed through an ‘in-house’ technology solution.

Now it turns out that one more new provider has emerged – namely “Benefitster” (full name: “Benefitster Employee Benefits and Risk Tech Ltd”), although the promoters assure us that strictly speaking Benefitster is not a startup.

So what is Benefitster?

Benefitster is a pure IT provider. It does not offer any savings plans or funds – instead, it offers a full-stack IT platform for financial institutions (e.g., fund managers, banks, insurers) seeking to enter the End-of-Service Savings market quickly and at low cost.

The Benefitster solution, in a nutshell, consists of three main components:

-

A robust industry grade pension administration system which we are told is already in use in more than 12 countries managing over 4 million employee accounts within thousands of employer schemes, underpinned by a full accounting system and live interaction with banks, tax and HR authorities

-

An open API to connect to fund managers and bank custodians, either to individual fund managers or to fund panels such as Allfunds.

-

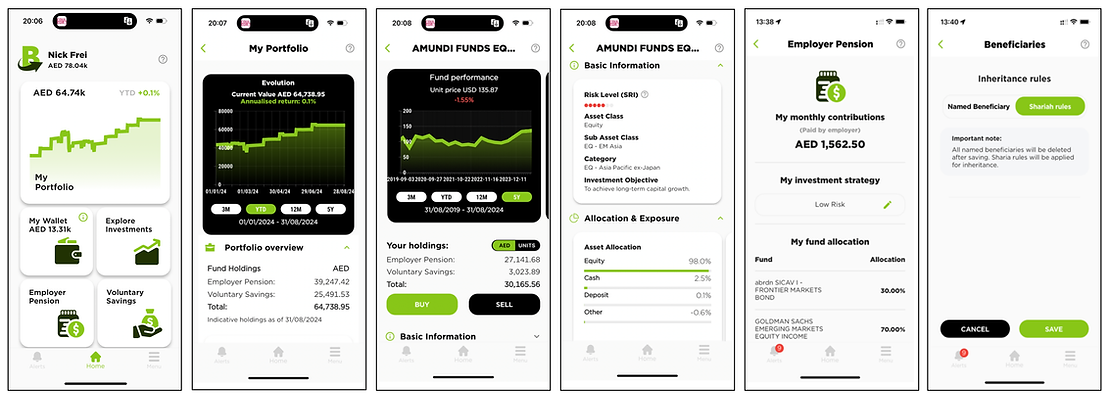

An employee app through which employees can steer their investments, track performance, buy/sell fund units from multiple funds, make additional voluntary contributions, generate statements, access financial literacy tools, and so on.

Pension Administration System

The pension administration system has been sourced from South Africa, which is known to be a very sophisticated market for End-of-Service Savings plans. Indeed, the South African equivalent of “Cabinet Resolution 96” was introduced over 30 years ago and the said system has since been rolled out to over a dozen countries, and currently runs pension savings plans for over 4+ million employees.

The system is said to be equipped to handle even the most complex scenarios. In fact, similar to insurance policy administration systems, or core banking platforms, pension administration systems too are hard to build as the complexity and interaction between employers, schemes, employees and investment funds can be overwhelming – not to mention the various reporting, compliance and audit requirements stipulated by regulators.

Benefitster went on to explain with an example.

Let’s say a fund manager has 1,000 corporate clients who each have 100 employees, and there are 5 funds to choose from. That means at the end of the month up to 500,000 fund trades need to be executed and accounted for. However, the Benefitster pension administration is clever enough to aggregate the trades, so that only 1 bulk order per fund is transmitted to the fund manager. This makes accounting and settlement with custodians much simpler, and it also saves costs, which in turn enables fund managers to offer more competitive funds and expand their profit margin.

There are many more such use cases for e.g., handling different currencies, defining vesting schedules for different money types, adding group life insurance plans and much, much more.

This is where the maturity and experience of a tried and tested pensions administration system comes into play, and where newly created systems are at a distinct disadvantage, as they simply cannot compete against a software solution that has been continuously developed and invested into over 20+ years.

We also discussed in a previous article how pure play fund managers are at a disadvantage when compared to insurers that are equipped with tools when it comes to decumulation strategies and annuities, amongst others. Benefitster may well fill this is gap from a technology perspective.

Employee App

The employee app on the other hand is brand new, and has been developed using the latest mobile technology we are told. It incorporates the UAE-specific business process in line with Cabinet Resolution 96, and is fully adapted to the UAE market. The app serves as a “cockpit” where employees have the opportunity to control all aspects of their end of service savings. See screenshot of the app below (full screen view recommended).

Open API

The API to the fund managers/custodian banks is said to be very flexible and can work with multiple fund managers providing multiple rent funds, not just a connection to a single fund manager.

Now, this is potentially very interesting as this opens up the possibility in future for companies to access multiple funds from multiple SCA-approved providers. This, we believe, could be a great market opportunity addressing some of the shortfalls of Cabinet Resolution 96 and one that will encourage a healthy market competition. (Regulators – Take note).

Who is behind Benefitster?

Benefitster was set up back in 2022 by two industry veterans: Ruan van Rensburg, the founder of Lux Actuaries and Consultants, and Nick Frei, an insurance executive who has had a long career as senior executive of several insurance companies.

Given their global experience in insurance, investments and pensions, they were quick to realise that the changing End-of-Service legislation in the UAE would call for a proven pension administration solution. Together with a team of local and international software and business process specialists they have developed this best-of-breed solution, adapted and targeted to the UAE End-of-Service Savings market.

Benefitster is incorporated in the UAE.

How much does it cost?

Benefitster has not disclosed its pricing but we are informed that the software is available as a service (SaaS) and pricing is variable. Well, that makes it clear that is there no hefty upfront payment.

On further probing, it turns out that clients (financial institutions) can access the software by paying either a fractional percentage of the Assets under Management (AuM) or a fee per employee per year. The exact rates were not shared with us, however given its business model, Benefitster thinks that it is comfortably the cheapest service provider in the market, and is able to offer prices roughly half of what the industry leader charges.

Our view

The solution comes across as quite impressive for those financial services companies seeking to enter the End-of-Service Savings market.

The pension administration system is no doubt very robust. The fact that it has been in the market for 20 years already, and that over 4 million employees from many countries are running on the software offers great peace of mind – in contrast to IT startups, given that the accounts of hundreds of thousands of employees could get muddled up!

For pure play fund managers, this may be an ideal solution to level up to the value-added offerings of a protection and savings insurance company, at least from a technology perspective.

The employee app appears to be quite smart, and brings the whole End-of-Service Savings functionality to every employee in a simple yet powerful manner.

Pricing as well is reportedly very competitive and flexible. But more importantly, the Benefitster team is hugely experienced and credible, which should help in discussions on business and operational issues with clients, regulators and other stakeholders.

We are told that Benefitster is in discussions with several financial institutions at present. It is to hope that this neat technology will soon find its way to the UAE End-of-Service Savings market.

Please follow Pensions Monitor for the latest news and developments on EoSS in the UAE.