In recent weeks, we’ve been exploring how countries across the Gulf Cooperation Council (GCC) are restructuring End-of-Service Benefits (EOSB). We began with Oman last week. Next in the series is the Kingdom of Bahrain and interestingly, Bahrain has been the first in the region to fully switch from the traditional gratuity model to a funded […]

So far, most of our articles have focused on developments around the End-of-Service Benefits (EOSB) in the United Arab Emirates (UAE). But similar reforms have also been progressing across the wider Gulf Cooperation Council (GCC) region. Over the next couple of weeks, we’ll bring you up to speed on what the UAE’s neighbours are doing, […]

Ever since Cabinet Resolution 96 of 2023 introduced the new Alternative End-of-Service Benefits (EOSB) Savings Scheme in October 2023, interest in workplace savings schemes has grown significantly in the United Arab Emirates (UAE). While a few companies are evaluating their options internally, the majority rely on advisors and consultants for guidance. In doing so, companies […]

Yes, it’s that time of the year again: The 2026 budget awaits! It’s the time when Finance is crunching numbers, and every department (HR included) needs to formulate, quantify and justify their plans, projects and costs. Given that it is “budget season”, we would like to ask HR Managers: Have you included End-of-Service Benefits (EOSB) […]

Time really does fly and it’s hard to believe that Cabinet Resolution No. 96/2023 is already two years old! For our newer readers (and for anyone still getting familiar with it), this regulation introduced the new End-of-Service Benefits (EOSB) Savings Scheme as an alternative to the gratuity system back in October 2023. (We at Pensions […]

Emirates NBD, a leading banking group in the Middle East, North Africa and Türkiye (MENAT) region, has signed a Memorandum of Understanding (MoU) with Fidelity International (‘Fidelity’) to work together on a new workplace savings proposition for employers in the UAE. This collaboration brings together Emirates NBD’s deep-rooted knowledge of local markets leveraging the capabilities […]

If you are a parent with a child in a Dubai-based school, you may have received a letter this week about a new survey being conducted by the Knowledge and Human Development Authority (KHDA), the government authority responsible for regulating and overseeing the quality of private education in Dubai. The survey invites all Year 8 […]

Last year, we wrote about Aurem as one of three early-stage startups vying for a place in the UAE’s workplace savings market. Today, Aurem has become the first digital platform for End-of-Service Benefits (EOSB) savings to have successfully integrated with MOHRE (Ministry of Human Resources and Emiratisation). Who is Aurem, and why is this integration […]

On 20 June, Umami Comms DMCC (Umami Comms), a creative communications agency based in Dubai Multi Commodities Centre (DMCC), hosted a financial wellbeing session for its employees. With rising living costs becoming a top-of-mind concern for many UAE residents, Umami Comms’ initiative was indeed timely and thoughtful, to guide employees and give them ways to […]

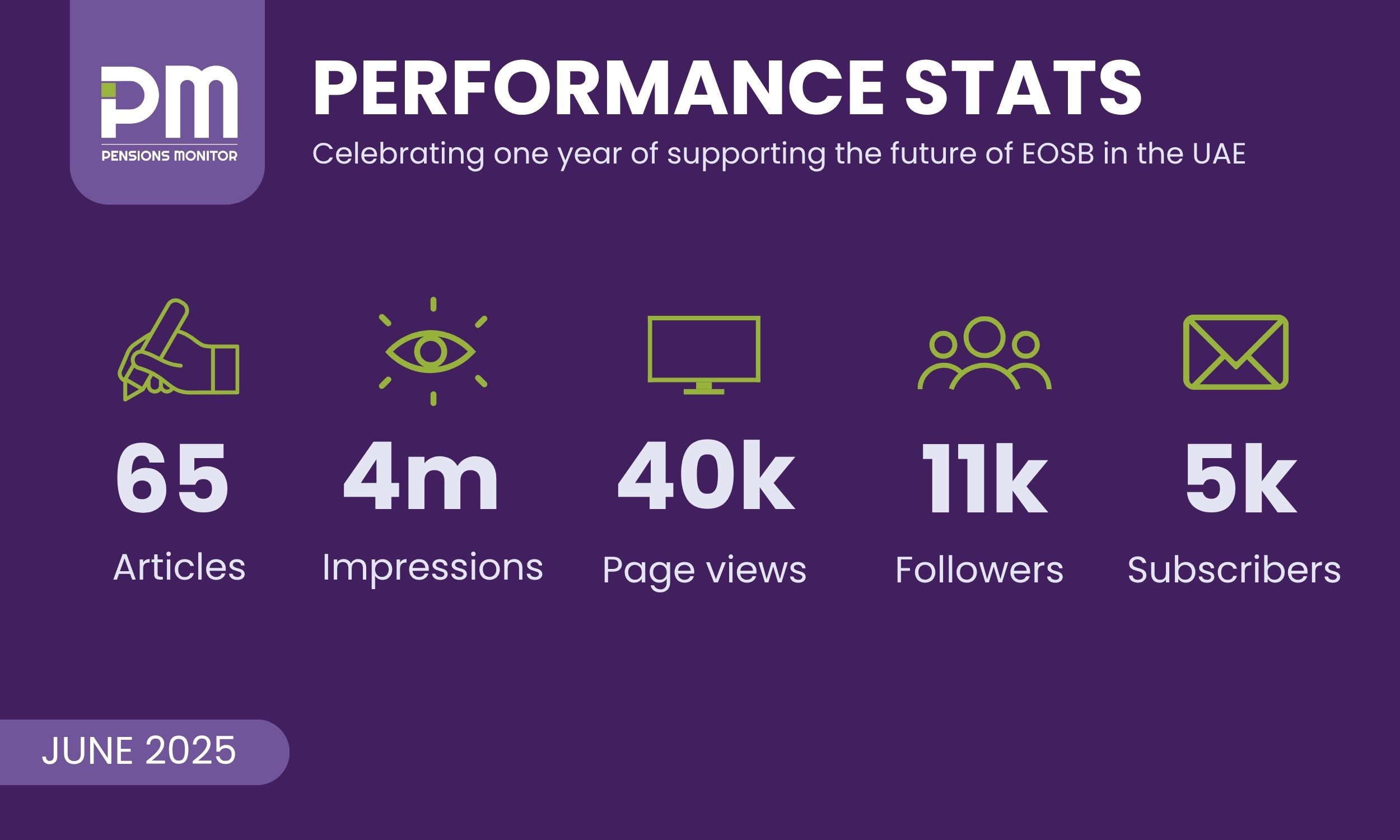

Yes, you have read that right. Pensions Monitor has just completed a year! It was exactly one year ago since we published our first article on the new UAE End of Service Benefits (EOSB) Savings scheme. In the 12 months since, we’ve worked hard to bring you the latest developments, market insights, and expert commentary […]