Last year, we wrote about End-of-Service Benefits (EOSB) Contributions paid to funds being an allowable expense for Corporate Tax (CT) purposes, subject to certain conditions. To recap: On the basis of Article 28 of the Federal Decree-Law No. 47 of 2022 (CT Law) that sets out the general rules for allowing deductions from profits for […]

Today’s article is authored by Ruan van Rensburg, CEO of Lux Actuaries Financial Consulting. The AUM model referenced in this article can be obtained from Nisha Braganza, Editor-in-Chief of Pensions Monitor. Please email Nisha at nisha@pensionsmonitor.com to request for the same. Background A recent special report by the European Court of Auditors on Developing Supplementary […]

Since its issuance in late 2023, Cabinet Resolution 96 of 2023 has clearly enabled companies in mainland UAE to offer the End-of-Service Benefits (EOSB) Savings Scheme – let’s call it the UAE EOSB Savings Scheme – as a replacement to the traditional EOSB Gratuity. But what about the freezones? There are said to be at […]

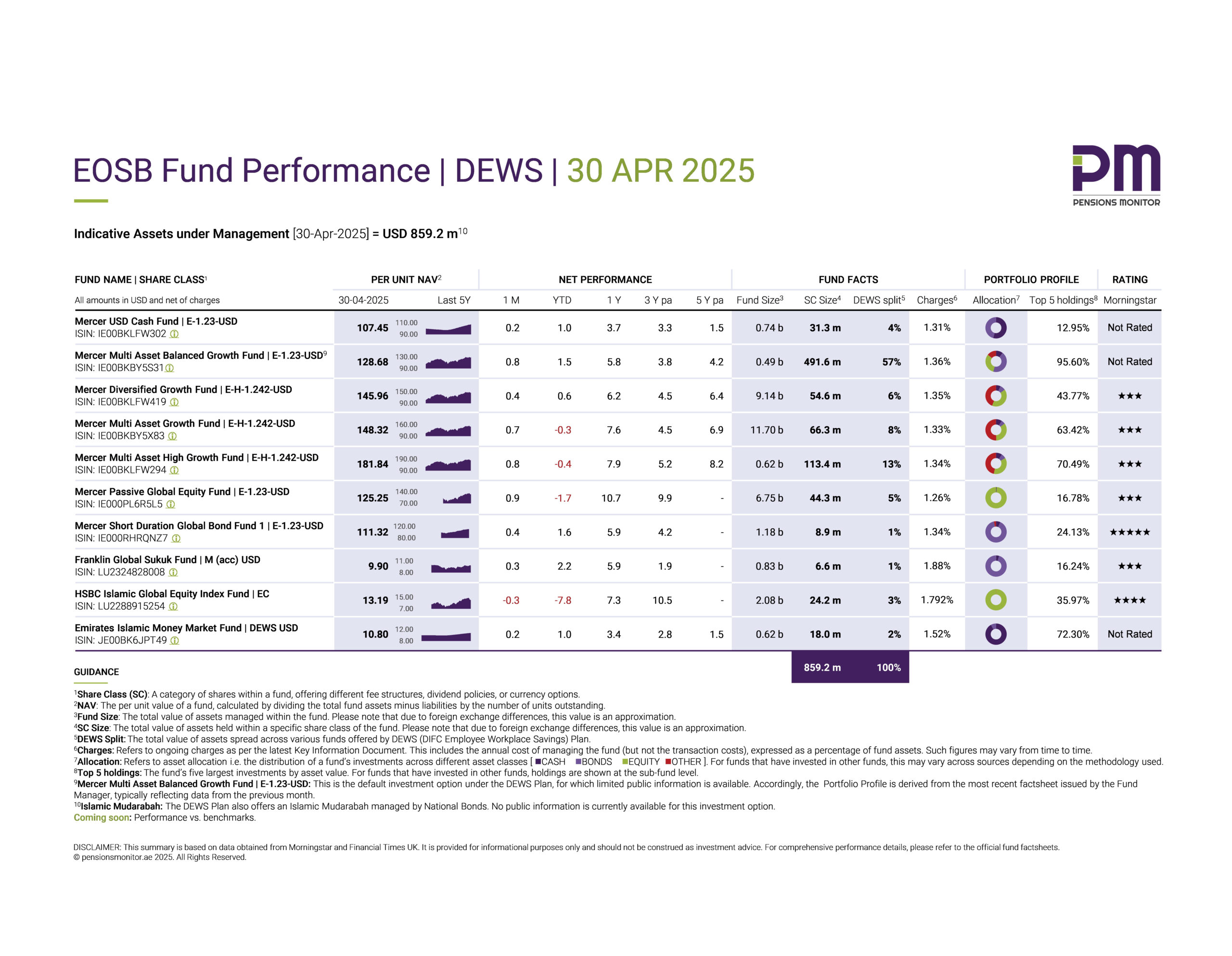

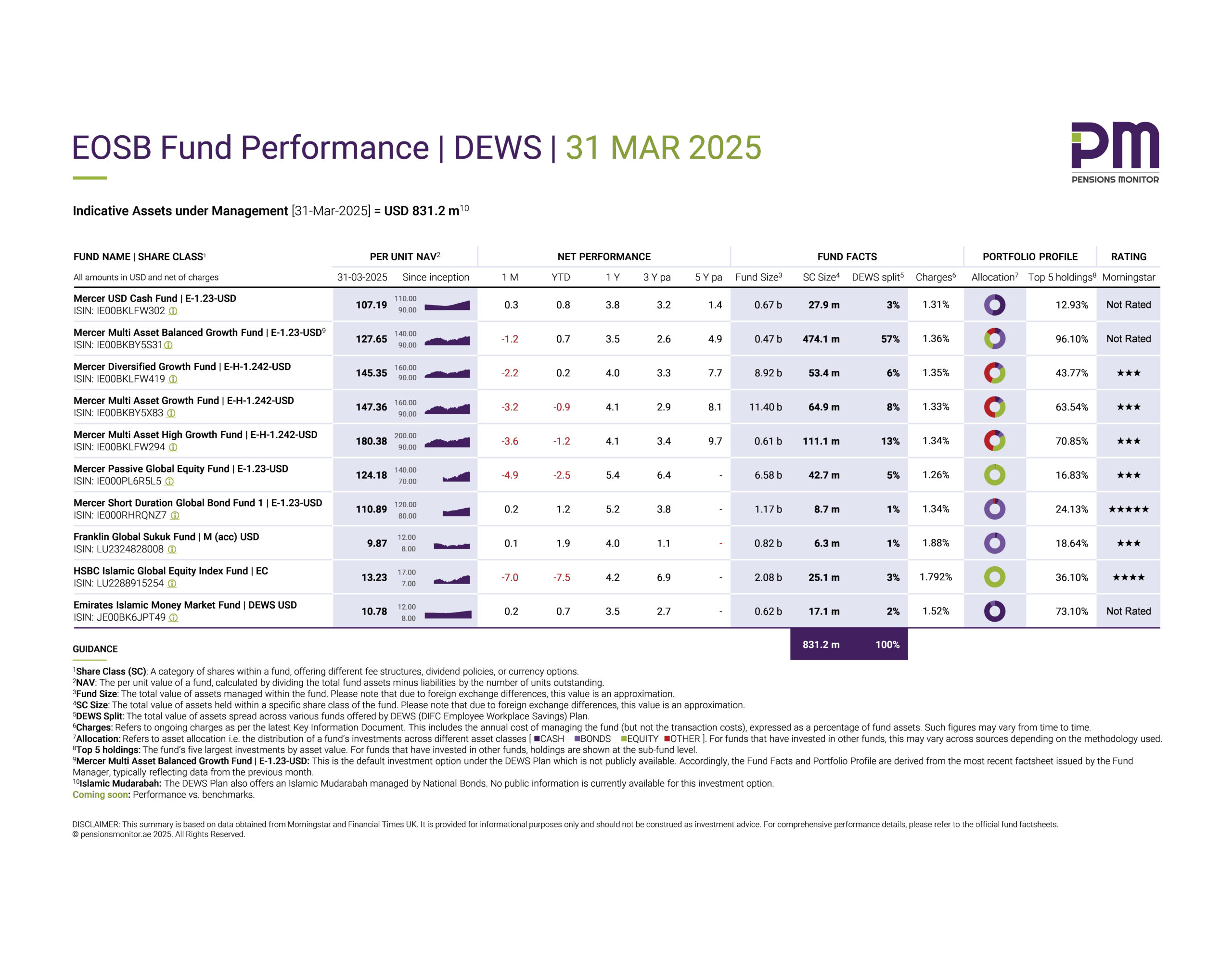

Global markets during April 2025 Global equities On 2 April 2025, United States President Donald Trump held a White House Rose Garden ceremony where he announced what he called a “reciprocal tariff” strategy. Subsequently, the worldwide stock markets took fright in dramatic fashion: For example, the Nikkei index shed almost 10%, as did the FTSE […]

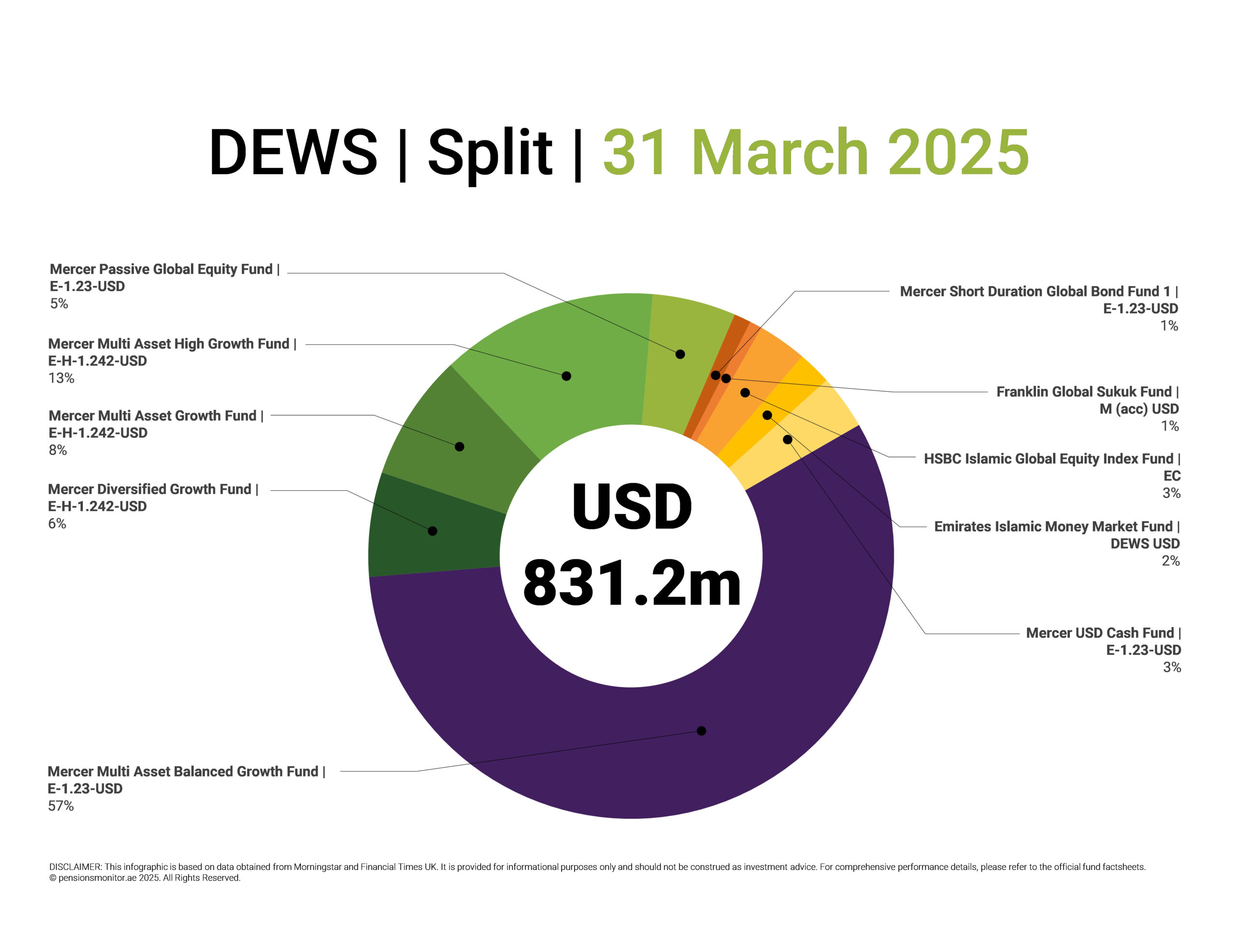

DEWS (Dubai Employee Workplace Savings), the first official End-of-Service Benefits (EOSB) Savings Scheme in the Dubai International Financial Center (DIFC), has now been operational for over five years. During this time, employers in the DIFC have been making regular contributions on behalf of their employees into investment funds, chosen by employees. Last week, we at […]

Pensions Monitor rolls out monthly dashboards As of today, the UAE’s official End-of-Service Benefits (EOSB) Savings Scheme includes 11 approved funds and within the Dubai International Financial Center (DIFC), DEWS offers 11 investment options, and GO SAVER adds another 16. With a growing list of options—and more providers expected—we thought it was time for a […]

Lunate, one of the four providers of the mainland End-of-Service Benefits (EOSB) Savings Scheme, recently announced new service partnerships for its EOSB Platform, Ghaf Benefits. The announcement follows the launch of six new funds by Ghaf Benefits, just a month ago. One of the new partnerships is with BNY (Bank of New York Mellon), the […]

By now, many readers will be familiar with the new End-of-Service (EOS) Saving scheme that has been introduced. And of course, we all know how the current EOS Gratuity system works. As more and more HR professionals, company managers, financial services professionals and employees are familiarizing themselves with the new scheme, many will ask: So, […]

With Emiratization targets increasing year-on-year for the private sector, HR professionals and employers are considering various options for hiring UAE nationals. One question that was recently raised is whether retired UAE nationals who re-enter the private sector workforce are eligible for the End-of-Service Benefits (EOSB) Savings scheme. While we know that UAE nationals are required […]

31% of UAE employees want retirement savings plans, according to Zurich’s 2024 Future of Work Survey

Zurich Insurance, a prominent insurer in the UAE and administrator of the DIFC Workplace Employees Savings scheme (DEWS), recently released the fourth edition of its annual Future of Work survey. This year’s survey based on feedback from 2,000 employers and 2,000 employees across the UAE (50%), Saudi Arabia (25%), Qatar, and Bahrain reveals the critical […]