The DEWS Annual Report 2024 is now out, and it’s packed with information.

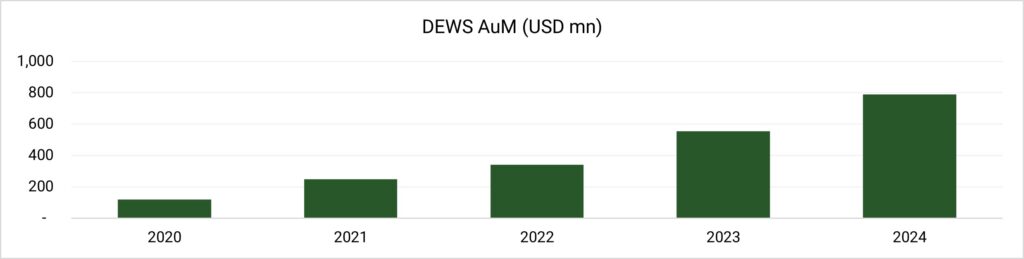

DEWS has seen a steady growth in Assets under Management (AuM), driven by more employers, more employees, accumulated contributions over time and steady investment gains.

Total AuM reached USD 789mn by the end of 2024, and is estimated at USD 889mn as at 31 May 2025. At the current growth rate, it is expected that DEWS will cross one billion dollars in AuM before the end of 2025.

Steady growth in employers and members

DEWS covers two segments: (a) DIFC employees, and (b) the expatriate employees of Dubai Government entities. As seen below, growth in employers and members is largely from the DIFC segment, clearly demonstrating the sustained popularity and success of the DIFC freezone. Dubai government employees grew marginally to 10.4k employees, bringing the total DEWS membership to 47,888 in 2024. Membership will likely exceed 50K members by the end of 2025.

| DIFC | DIFC | Dubai Government | Dubai Government | Total | Total | |

|---|---|---|---|---|---|---|

| 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | |

| Employers | 1,692 | 2,025 | 69 | 71 | 1,761 | 2,096 |

| Employees | 31,468 | 37,435 | 10,122 | 10,453 | 41,590 | 47,888 |

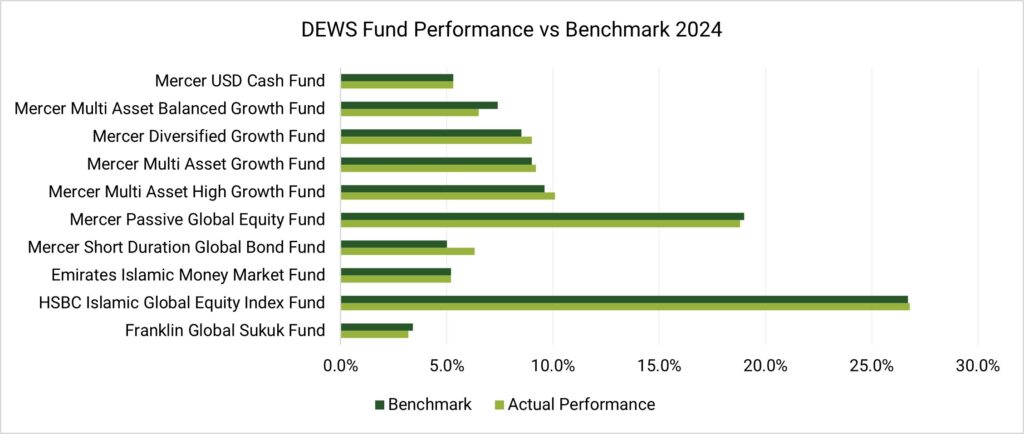

DEWS generated USD 41.8mn in investments gains

DEWS generated USD 41.8mn in investment gains for plan members in 2024. If the return is averaged over the year’s opening and closing AuM, it works out to a net return of 5.9%.

Over five years, cumulative investment gains reached USD 73.9mn, all of which go directly to members. That’s a substantial benefit, and a clear reminder that savings schemes work best over the medium to long term, where time, compounding, and consistent contributions do the heavy lifting, even with normal market ups and downs.

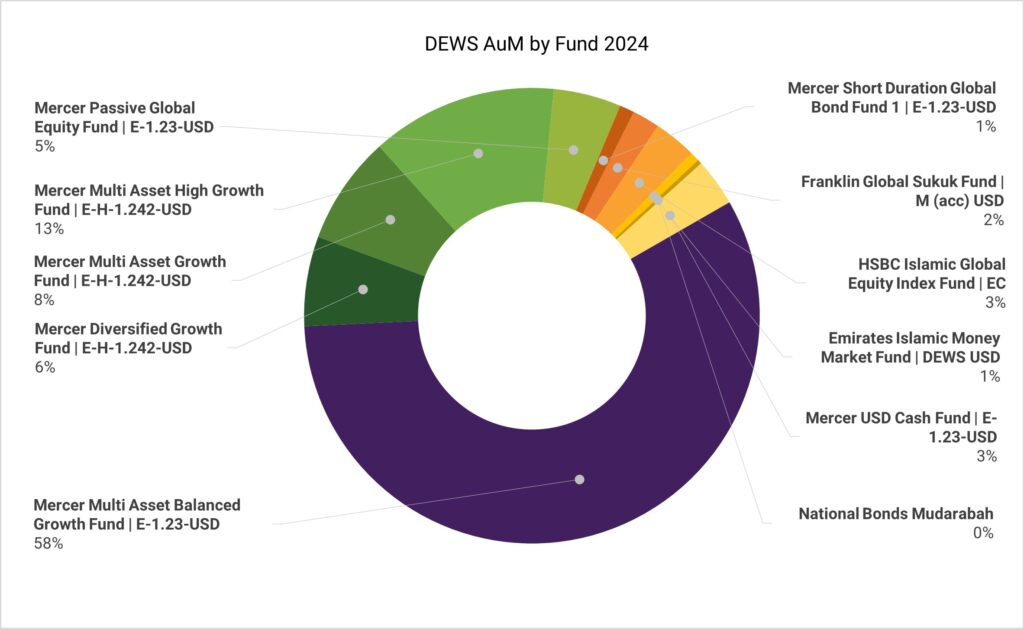

The 2024 returns are good, and by and large most funds have outperformed or met the selected benchmarks. Among those that didn’t is the default fund (Mercer Multi Asset Balanced Growth) whose goal was to beat the FTSE USD 1-month Euro deposit index by 2%. This fund returned 6.5% against a target of 7.4% – not a disaster, but certainly one to watch closely, especially since 58% of AuM is invested in this fund.

We flagged this concentration in a previous article – possibly the result of member inertia. But it does raise an intriguing question as to what will likely happen on the mainland, where most employees are unlikely to have the same level of financial literacy as those in the DIFC. Will many simply remain in the default fund? And if so, how important will fund range and choice actually be if most people never use it? Time will tell.

The charges remain unchanged at 1.23%

Nothing in life is free, and neither is the DEWS plan. The fees remain unchanged at 1.23% since the plan’s launch. This is split across the service providers: 0.20% goes to the Scheme Operator (Equiom), 0.80% to the Plan Administrator (Zurich Workplace Solutions), and 0.23% to the Investment Adviser (Mercer).

But as the AuM ramps up, so does the total revenue for these providers in absolute terms. Can DEWS now afford to deliver the same service more cost-effectively? We will take a closer look at this in an upcoming article.

Final thoughts

Overall, a big congratulations to the DEWS team for five years of steady growth and overall solid performance. While returns have varied year-on-year, the plan has continued to build value and generate profits that will go directly into the pockets of the plan members.

Pensions Monitor looks forward to tracking the fortunes of DEWS and its new competitor GO SAVER through the monthly EOSB fund performance dashboards, and naturally, the aim is to do the same with the emerging mainland scheme providers.

If you found this article of interest, please do share it and sign up to Pensions Monitor’s free newsletter to stay updated on EOSB and related topics!

Disclosure Statement Issued in accordance with the UAE Securities and Commodities Authority’s Finfluencer Regulation. Article: DEWS expected to cross USD 1bn in AuM in 2025 Author: Nisha Braganza Capacity: Natural person SCA Finfluencer Registration: 012 Data sources: DEWS Annual Report 2024 and other sources cited in the Article Data date: 31 December 2024 Price time reference: As per “Data date” Publication date: 30 June 2025 Target audience: Employers/employees tracking EOSB Savings Schemes in the UAE Validity: Not applicable Nature of content The Article provides a factual summary and commentary on the DEWS Annual Report for the year ended 31 December 2024. Factual summary includes the Assets under Management, actual performance vs. benchmark by fund, allocation by fund, and charges. These are sourced from “Data sources” and has not been modified. Commentary is the author’s opinions and interpretations of the data and does not constitute financial advice or a recommendation to buy, sell, or invest in any fund. Limitations While reasonable care has been taken to ensure objectivity, balance, and clarity, the Author has relied on “Data sources” without independent verification. Accordingly, the Author does not accept responsibility for the accuracy or completeness of “Data sources”. Past performance is not indicative of future results and commentary does not represent expected outcomes. Previous Articles on the subject are available on www.pensionsmonitor.com. Conflicts of interest The Author has not received any compensation from the respective fund issuers, nor holds investments in any of the funds mentioned. No party involved in this publication has a commercial relationship with the respective fund issuers or EOSB Scheme managers. Investment advice disclaimer Investors are advised to consult with a financial advisor licensed by the UAE Securities and Commodities Authority or other relevant authority, before making investment decisions.