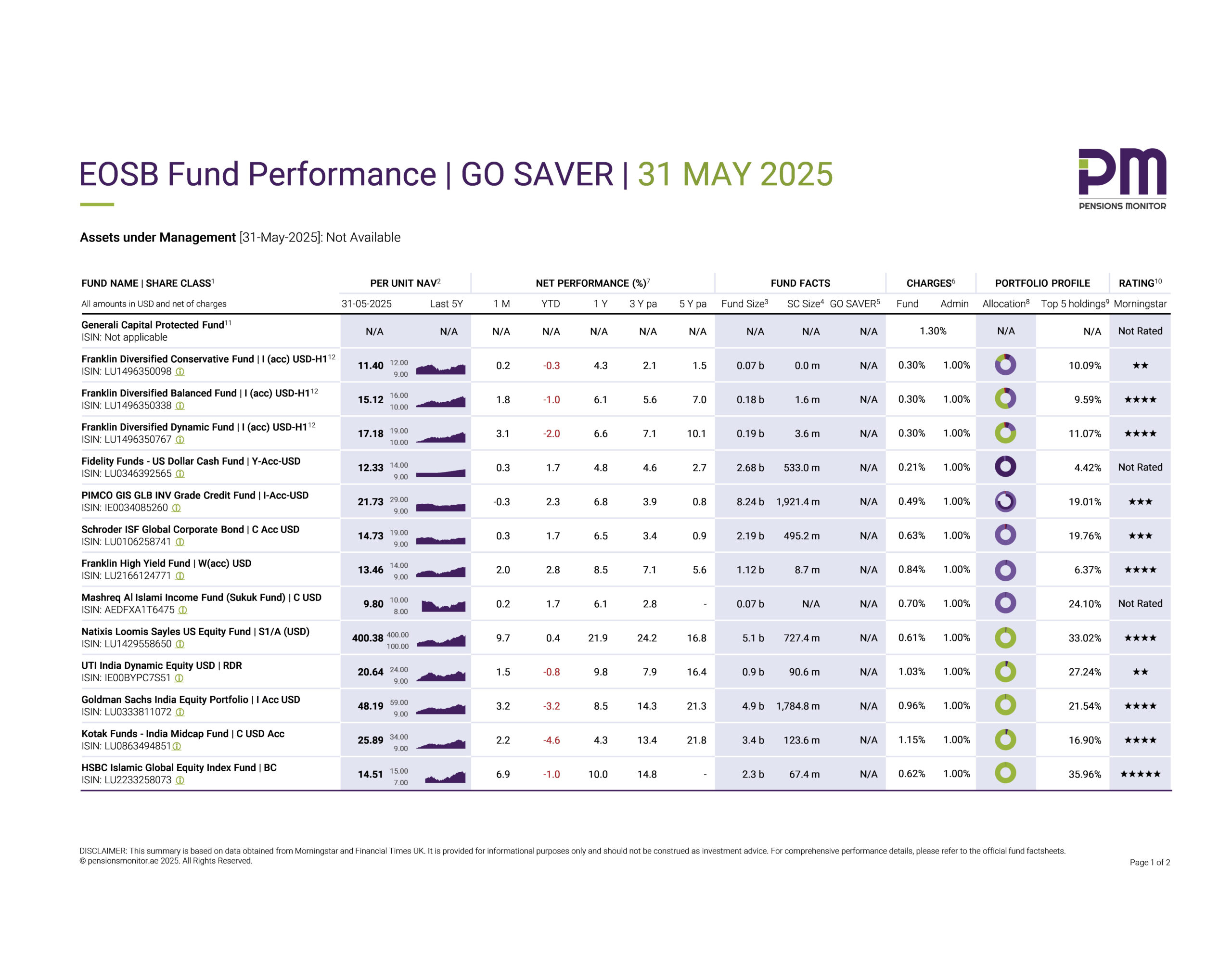

EOSB Fund Performance | GO SAVER | 31 MAY 2025

GO SAVER as well, has generally had a good month in May as did DIFC’s other workplace savings plan DEWS.

👉 Click here to download the dashboard.

For background, GO SAVER currently offers 14 funds, one of which – the Generali Capital Protected Fund – has no publicly available information. Therefore, this commentary excludes it. For a full understanding of the GO SAVER fund line-up, please click here.

On to the performance of the remaining 13 funds in May 2025:

Bond-based funds

Clearly, bond-based funds have done well year-to-date (YTD). (You can easily spot the bond-based funds in the dashboard as those having a largely purple ‘doughnut’ graph).

In particular, Franklin’s High Yield Fund (up 2.8% YTD), and PIMCO’s GIS Global Institutional Investment Grade Credit Fund (up 2.3% YTD).

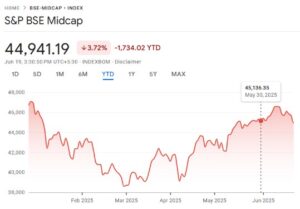

Equity-based funds

Firstly, it is commendable that GO SAVER offers a selection of Indian equity funds. These may be particularly attractive to Indian expats in the UAE who plan to retire back in India, and are therefore interested in investing their savings in funds that align with their future living costs. It is of course, also attractive to other investors seeking some exposure to a fast-growing emerging market economy.

When assessing the performance of Indian equity funds, two factors must be considered: first, the performance in the original currency (Indian rupees), and second, the movement of the rupee against the US dollar.

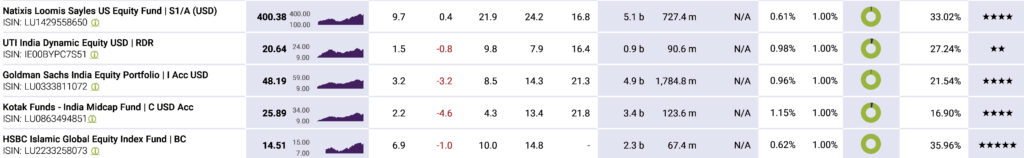

The Indian stock markets delivered modest gains YTD May 2025. After an initial dip in January and February, both the Nifty 50 and BSE Sensex rebounded, ending May with gains of 4.2% and 3.7%, respectively. However, broader indices like the S&P BSE 500 and Nifty 500, which cover ~95% of free float market capitalization of National Stock Exchange and Bombay Stock Exchange respectively, gained only around 1.4%.

In terms of currency, the USD/INR exchange rate has been volatile but ended the period almost where it started, hovering around 84–85 rupees per US dollar.

But despite the market’s overall recovery and strong returns in May, the Indian equity funds available through GO SAVER still show a negative YTD performance, due to the specific composition of their holdings.

The Goldman Sachs India Equity Portfolio, with 112 holdings spread across the Large Cap (55%), Mid Cap (13%) and Small Cap (29%), has declined -3.2%

The Kotak India MidCap Fund, with 76 holdings largely in the Midcap segment (84%), is down -4.6% YTD much inline with the S&P BSE Midcap and Nifty Midcap 50 that were down 3.3% and 0.3% YTD.

Another equity-based fund still to recover YTD is the HSBC Islamic Global Equity Index Fund, down 1% YTD. This fund is actually available in the DEWS panel as well (under a different share class, carrying higher charges than GO SAVER). Its performance was discussed in our last article (EOSB Fund Performance | DEWS | 31 May 2025).

These equity funds do carry relatively higher risk ratings, ranging from 5 to 6 out of 7. Risk ratings are another important consideration to help investors compare funds more easily. This will be introduced to the PM dashboards from June 2025 onwards.

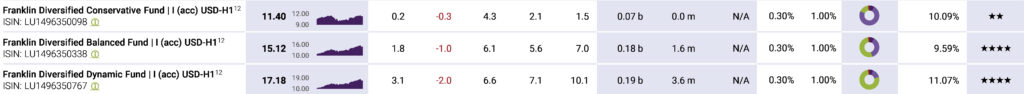

Balanced funds

As the name suggests, balanced funds are neither fully equity-based nor fully bond-based, but a mix of the two.

GO SAVER offers three of them: Franklin Diversified Conservative Fund (down 0.3% YTD), Franklin Diversified Balanced Fund (-1.0% YTD), and the Franklin Diversified Dynamic Fund (-2.0 YTD).

As the red ink suggests, so far, they have lost some value this year. However, all three funds showed a strong rebound in May and historically, have performed well over 3-5 years. Their loss in value this year, is partly due to their holdings composition, for example in US stocks like Apple and Alphabet (=Google) which have come under pressure this year.

Final thoughts

As always, it should be reiterated, that EOSB Savings Schemes such as GO SAVER are designed for medium- to long-term investing. Hence, it is not about daily or even monthly returns and in the case of equity-based funds, it is quite normal to experience some volatility and occasional losses, particularly during volatile times, such as the first half of this year.

In fact, there is a positive side to this. For those looking to join GO SAVER now, current prices may offer a better entry point than past highs. And for ongoing EOSB savers, short term dips can work in their favour, where regular employer contributions allow for more fund units to be purchased during periods of lower prices.

As GO SAVER is still relatively new, and employer participation steadily growing, this could be a timely opportunity for employees to start building their savings.

Disclosure Statement Issued in accordance with the UAE Securities and Commodities Authority’s Finfluencer Regulation. Article: EOSB Fund Performance | GO SAVER | 31 May 2025 Author: Nisha Braganza Capacity: Natural person SCA Finfluencer Registration: 012 Data sources: Morningstar, Financial Times UK and factsheets, cited in the Article Data date: 31 May 2025 Price time reference: NAVs used reflect end-of-day pricing as of “Data date” Publication date: 25 June 2025 Target audience: Employers/employees tracking EOSB Savings Schemes in the UAE Validity: 30-day period from "Data date", unless updated Nature of content The Article contains a dashboard (factual data and performance data) and accompanying commentary. Factual data includes Net Asset Value (NAV) per share, fund size, share class size, asset allocation, charges, top holdings, and ratings. These are sourced from “Data sources” and has not been modified. Performance data is calculated using a proprietary time-weighted return model, based on daily NAV movements. The model does not involve forward-looking assumptions or forecasts. Commentary is the author’s opinions and interpretations of the data and does not constitute financial advice or a recommendation to buy, sell, or invest in any fund. Comparisons between funds are based on publicly available information. These do not represent endorsements and have been drafted impartially, without bias or exaggeration. Limitations While reasonable care has been taken to ensure objectivity, balance, and clarity, the Author has relied on “Data sources” without independent verification. Accordingly, the Author does not accept responsibility for the accuracy or completeness of “Data sources”. Past performance is not indicative of future results and commentary does not represent expected outcomes. Previous Articles on the subject are available on www.pensionsmonitor.com. Conflicts of interest The Author has not received any compensation from the respective fund issuers, nor holds investments in any of the funds mentioned. No party involved in this publication has a commercial relationship with the respective fund issuers or EOSB Scheme managers. Investment advice disclaimer Investors are advised to consult with a financial advisor licensed by the UAE Securities and Commodities Authority or other relevant authority, before making investment decisions.