Since its issuance in late 2023, Cabinet Resolution 96 of 2023 has clearly enabled companies in mainland UAE to offer the End-of-Service Benefits (EOSB) Savings Scheme – let’s call it the UAE EOSB Savings Scheme – as a replacement to the traditional EOSB Gratuity.

But what about the freezones?

There are said to be at least 47 official freezones operating in the UAE. That’s a substantial count covering a considerable portion of the UAE workforce. Are these freezones also covered by Cabinet Resolution No. 96 of 2023? And more importantly, can freezone companies enroll in the UAE EOSB Savings Scheme today?

We at Pensions Monitor, have done the research and spoken to a few freezone authorities. Here’s what companies and employees in freezones need to know.

DIFC: A clear trailblazer

Let’s start with the easy one – Dubai International Financial Center (DIFC).

In this prominent freezone, the employment regulations were indeed updated in 2020 to introduce a mandatory EOSB Savings Scheme (see DIFC Employment Law No. 2 of 2019, as amended by DIFC Law No. 4 of 2020).

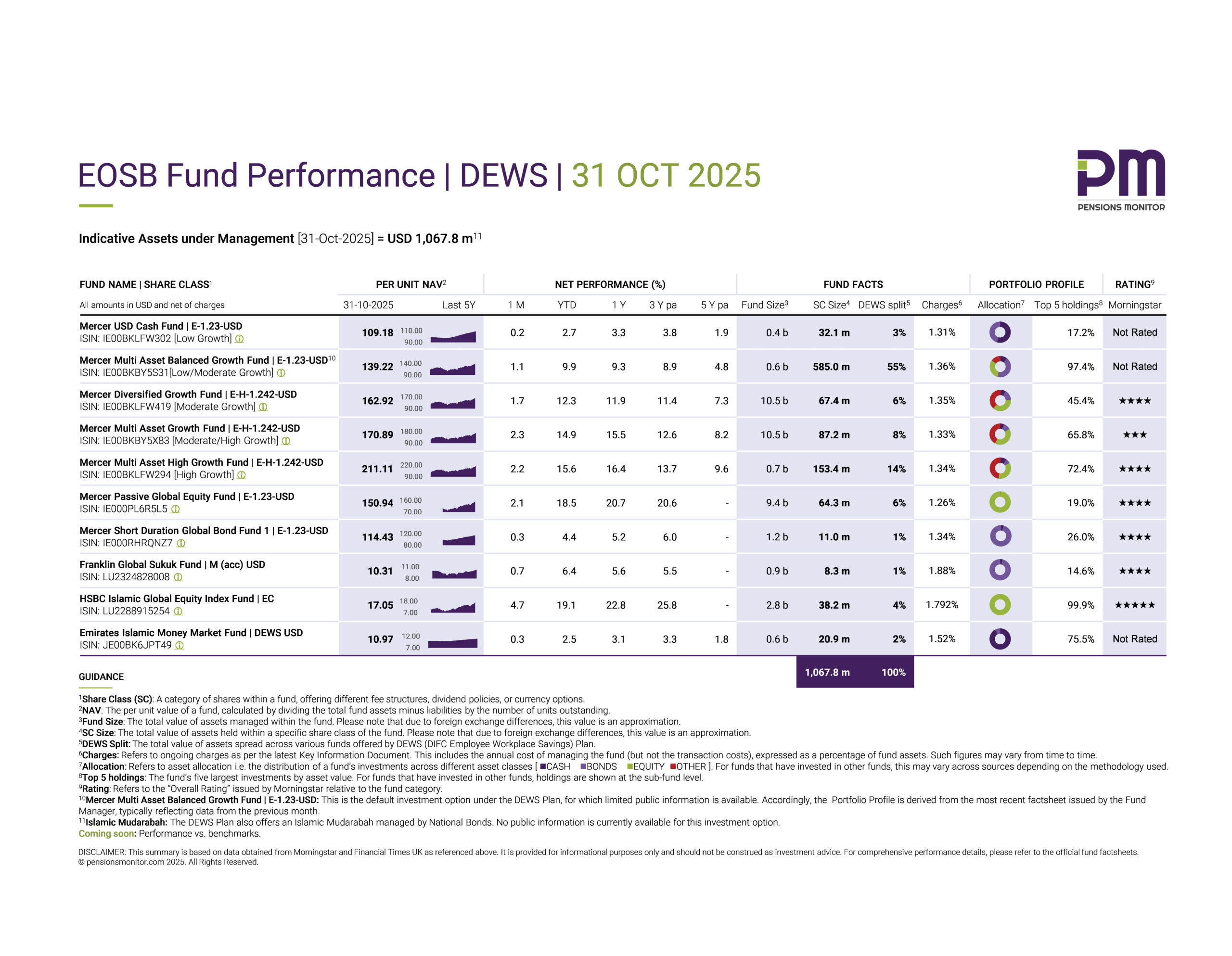

In other words, the DIFC had amended the legal basis for EOSB Gratuity, to allow for an EOSB Savings Scheme that mandatorily replaced EOSB Gratuity for all companies in the freezone. DEWS (DIFC Employee Workplace Savings) became the first official scheme in 2020, followed by GO SAVER, launched earlier this year.

ADGM: Optional participation, dual consent

Let’s take another example – Abu Dhabi Global Market (ADGM). Here the situation is less straight-forward.

Yes, ADGM did amend its employment regulations with effect from 1 April 2025 (see Article 61 of the updated ADGM Employment Regulations here). The new rule, in a nutshell, allows employers to offer a pension and/or savings scheme as an alternative to traditional EOSB Gratuity.

But unlike the DIFC, transitioning to a pension and/or savings scheme is entirely optional for companies, and employee participation is also dependent on employee consent.

Another striking difference is that ADGM has not officially designated any EOSB savings scheme providers yet. Based on our enquiries, employers can approach pension and/or savings scheme providers directly to explore eligibility. However, the absence of official schemes currently places the burden on employers to verify compliance independently.

Other freezones

So far so good. But what about the remaining 45 freezones?

Based on our research, most other freezones follow – broadly speaking – the Federal Decree-Law No. 33 of 2021, and its amendments (UAE Labour Law) as the baseline for employment, but supplement it with free zone-specific regulations. These may include variations in visa processes, working hours, administration and such like.

Particularly, with respect to EOSB, most freezone employment regulations explicitly refer to the UAE Labour Law as a minimum or adopt its provisions by default. For e.g., the Jebel Ali Free Zone (JAFZA), Dubai Multi Commodities Centre (DMCC), Dubai Silicon Oasis (DSO) and Dubai Design District (D3), amongst many others.

Now, based on our enquiries with a selection of freezones, it turns out that this legal alignment with the UAE Labour Law means that Cabinet Resolution No. 96 of 2023 is effectively “auto-enabled” even if not expressly restated in the freezone regulations. Therefore, such freezones do not see the need to specifically amend their employment regulations or their standard employment contract templates.

It was further confirmed that companies in such freezones can in fact voluntarily enroll in the UAE EOSB Savings Scheme today, if so desired, without needing any specific approval from the freezone authority to do so. The only requirement is a signed agreement between the employer and employee to shift from gratuity to a funded scheme.

But is enrolment of freezone companies in the UAE EOSB Savings Scheme actually happening today?

We also spoke to some approved EOSB fund managers. It was confirmed that freezone companies are eligible to enroll. However, we noted some ambiguity around documentation and administrative procedures. For e.g., some providers mentioned that approval from freezones may be required.

In short, it’s possible and legal, but procedural clarity is still evolving.

So far, our limited research has not identified any freezones that are not aligned with the UAE Labour Law in regard to EOSB, apart from DIFC and ADGM. These two financial freezones in fact operate under independent legal systems based on common law principles and are completely independent from the mainland regulations.

But, if you, dear reader, are aware of a freezone that follows a different model or deviates from the UAE Labour Law, please do write to us – or better yet, volunteer an article!

What happens in freezones if the scheme is mandated?

Right now, the UAE EOSB Savings Scheme is entirely optional for companies. But what happens in freezones if Cabinet Resolution No. 96 of 2023 becomes compulsory?

Our view at Pensions Monitor is that freezones already aligned with the UAE Labour Law will likely follow suit automatically. Most freezones already default to the UAE Labour Law in their employment frameworks. Since the Cabinet Resolution is an extension of that law, these freezones would automatically be required to comply, just like mainland companies.

What about DIFC and ADGM – will they align as well? Well, Cabinet Resolution No. 96 of 2023 explicitly states that it will apply to all financial freezones as well:

Approved Systems of Financial Free Zones

- As specified by the Ministry and the Authority, the conditions and obligations set forth in this annex apply to approved freezone systems.

- It is intended that any standards, conditions, or obligations imposed on the freezone systems pursuant to subparagraph (a) will be implemented in coordination with the relevant authorities within the financial freezones to determine which standards and obligations will be supervised and implemented by them on behalf of the Ministry or Authority.

But exactly how this will work in practice and whether it leads to alignment, coexistence, or carve-outs, remains to be seen.

Found this article useful?

This article was indeed an interesting learning for us at Pensions Monitor, and we must say that the responses from freezones were not always instantaneous. In most cases, our enquiries were referred to legal departments to confirm the scheme’s applicability — meaning that many freezones are still getting up to speed on this topic.

We’d love your feedback.

If you have thoughts, questions, or experiences to share, drop us a line at info@pensionsmonitor.com. And if there’s a topic that could benefit the wider community, we’re always open to exploring it.

And don’t forget to sign up for our free newsletter to stay updated on all things related to End-of-Service Benefits in the UAE.