GO SAVER, a new End-of-Service Benefits (EOSB) Savings plan for employees of the Dubai International Financial Center (DIFC or freezone) was officially launched on 28 January 2025, at the prestigious Waldorf Astoria, DIFC following its successful pilot phase in the last quarter of 2024. This launch marks an important development for DIFC, where DEWS (DIFC Employee Workplace Savings) was so far, the only available plan since the freezone transitioned from the gratuity system to a savings scheme in February 2020.

Now that GO SAVER is fully operational, DIFC employers seeking an alternative plan for their employees’ savings can easily transfer funds from DEWS. However, switching from a familiar provider is a big decision for any company and would require a compelling reason to do so. So, the obvious question we asked was: How is GO SAVER different and why would companies transfer?

Pensions Monitor had the opportunity to speak in-depth with the squad behind GO SAVER, and today’s article provides exclusive insights into the plan. Here’s what you need to know:

Renowned service providers

GO SAVER is designed in compliance with the DIFC regulatory framework and delivered by a consortium of globally renowned partners, offering beneficiaries access to a broad range of investment options (more on this later) and expert guidance.

The main partners include:

- Sukoon Workplace Savings Solutions Limited (SWSS), a wholly owned subsidiary of Sukoon Insurance, as the Administrator;

- CSC Trustee Services (Middle East) Limited (CSC) as Operator and Trustee;

- Franklin Templeton (FT) as Investment Manager;

- Enhance Group, a Jersey registered entity with USD 3bn+ assets under advice as Investment Advisor; and

- Generali Global Pension (Generali), a leading global insurer and asset manager with USD 0.9tn assets under management (AuM), leading the Capital Protected Fund (more on this later).

Proven technology

Technology is another key consideration for companies when choosing an EOSB Savings Plan.

The Service Portal Operator of GO SAVER is Kane Solutions. Kane Solutions reportedly specializes in technology solutions for international Life, Pension and Investments and has over USD 12bn AuM. The company is said to be operating since 2000 with offices in Bermuda, Malta, Mauritius and UAE. They hold a Category 4 Fund Administration License at DIFC.

We understand that Kane Solutions has a long-standing partnership with Sukoon, having previously digitized the distribution of certain life insurance products. Pensions Monitor will review the UI and UX of GO SAVER’s tech stack in the coming weeks and share our views in a separate article.

Broad range of funds

This is where GO SAVER truly stands out. As of now, it offers the widest range of investment options for EOSB savings in the UAE.

GO SAVER offers a total of 17 investment options, catering to varying risk profiles, including Sharia’h compliant options. Notably, the plan includes a Capital Protection Fund, which serves as the default investment option. This is a significant differentiator compared to other EOSB savings plans even in mainland UAE, which typically provide limited capital protection by setting aside a risk-adjusted capital buffer each year.

The Capital Protected Fund was launched by Sukoon and Generali in 2022 and guarantees 100% protection of both EOSB contributions and accumulated returns each year. Explaining by example the capital protection and ratchet effect, Lahlou Hanouti, Managing Director at Generali went on to say that if the EOSB contribution for a year is USD 100 and the return generated that year is 2%, then USD 102 is the capital guaranteed in the following year which will in turn generate further returns. This guarantee is backed by two layers of protection: a risk-adjusted buffer and reinsurance protection ensuring full capital protection irrespective of market conditions.

In terms of risk-based funds, GO SAVER offers three model portfolios (conservative, balanced and dynamic risk) managed by FT, a globally recognized asset manager with USD 1.68tn AuM and a strong presence in the Middle East. It is worth noting that both the Capital Protected Fund and the three FT model portfolios are conventional investment options.

For Sharia-compliant investments, GO SAVER offers two Sharia’h compliant funds within a range of 13 self-select funds across different risk appetites, asset classes and geographies, allowing beneficiaries to fully customize their portfolios.

A complete list of funds available through GO SAVER is featured in Pensions Monitor’s comprehensive directory of EOSB savings funds.

Competitive charges?

GO SAVER charges are said to vary depending on the selected investment fund/s.

For the Capital Protection Fund, a charge of 1.30% applies. This fee is deducted from the fund’s gross return and does not impact the principal contribution.

For self-select funds, the scheme levies a 1.00% fee (deducted monthly from the account value) as an operational charge. Additional charges apply by the respective fund managers, which may include ongoing administration fees, subscription fees, transaction fees, and exit charges. See Pensions Monitor’s EOSB Savings Funds for more information.

There are no charges for employees when switching funds, except for the subscription fees of the fund itself.

When asked how GO SAVER’s charges compare with DEWS, Djamel Chalabi, Senior Executive Officer at SWSS, explained that while competitiveness in charges has been considered, several other elements have also been taken into account in designing their offering. He added, “Companies are advised to assess the entire product including the investment solutions offered to members, funds performance, service standards as well as the overall ecosystem of GO SAVER with reputable companies in their respective role in the plan”.

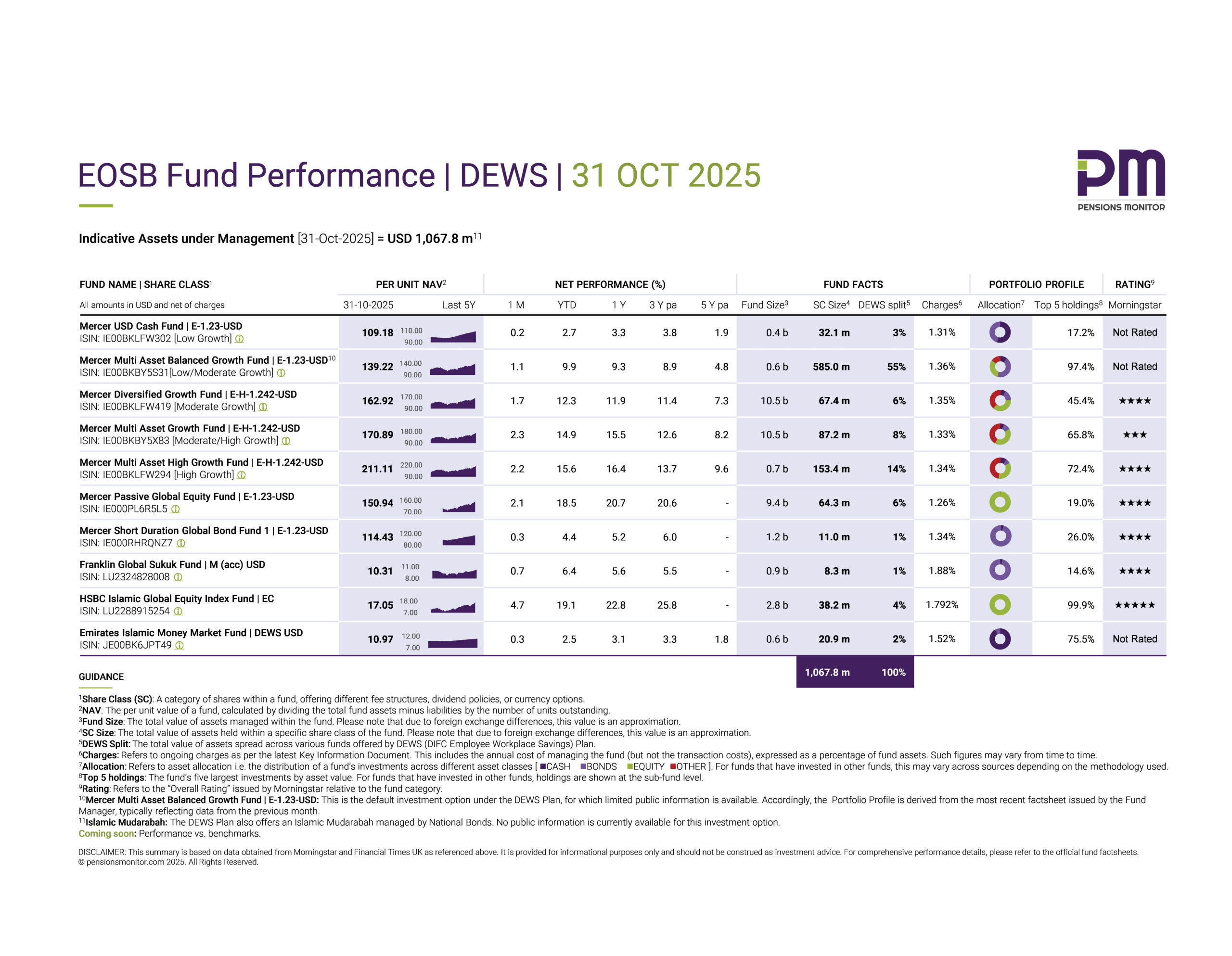

Fund performance

GO SAVER will publish its fund factsheets in the coming weeks. Pensions Monitor will track and report on the performance of these funds once they become available. Subscribe to our newsletter to be notified when performance updates are published.

Back to our question: Should companies transfer?

Whether companies should transfer to GO SAVER depends on various factors, but in short, the satisfaction level of employees with their current plan and the service standards of their existing provider.

Interestingly, DIFC does not require employers to engage with a single provider. Employees can be allocated across both DEWS and GO SAVER, as deemed fit by the employer. For companies wishing to transfer to GO SAVER, the process is relatively straightforward. The employer should initiate an application for a certificate of compliance (CoC) through the DIFC portal. Once issued, the transfer process can begin.

It is also interesting to note that in contrast to DIFC’s flexible multi-provider approach, mainland regulation Cabinet Resolution 96 mandates that companies use a single provider, forcing a uniform choice across the organization. It remains to be seen whether the mainland regulators will adopt the same flexibility as DIFC in the future.

Closing remarks

Emmanuel Deschamps, Chairman of the board of SWSS, expressed immense pride in the launch of GO SAVER that has been developed in partnership with globally renowned companies and also shared with Pensions Monitor, the company’s ambitious plans for the UAE’s workplace savings market.

Below are some images and footage from launch ceremony on 28 January 2025. Source: Sukoon Workplace Savings Solutions Ltd.

Be sure to follow us for more interesting developments in the EOSB Savings market and sign up to our free newsletter today for direct notifications to your inbox.