EOSB Fund Performance | GO SAVER | 31 OCT 2025

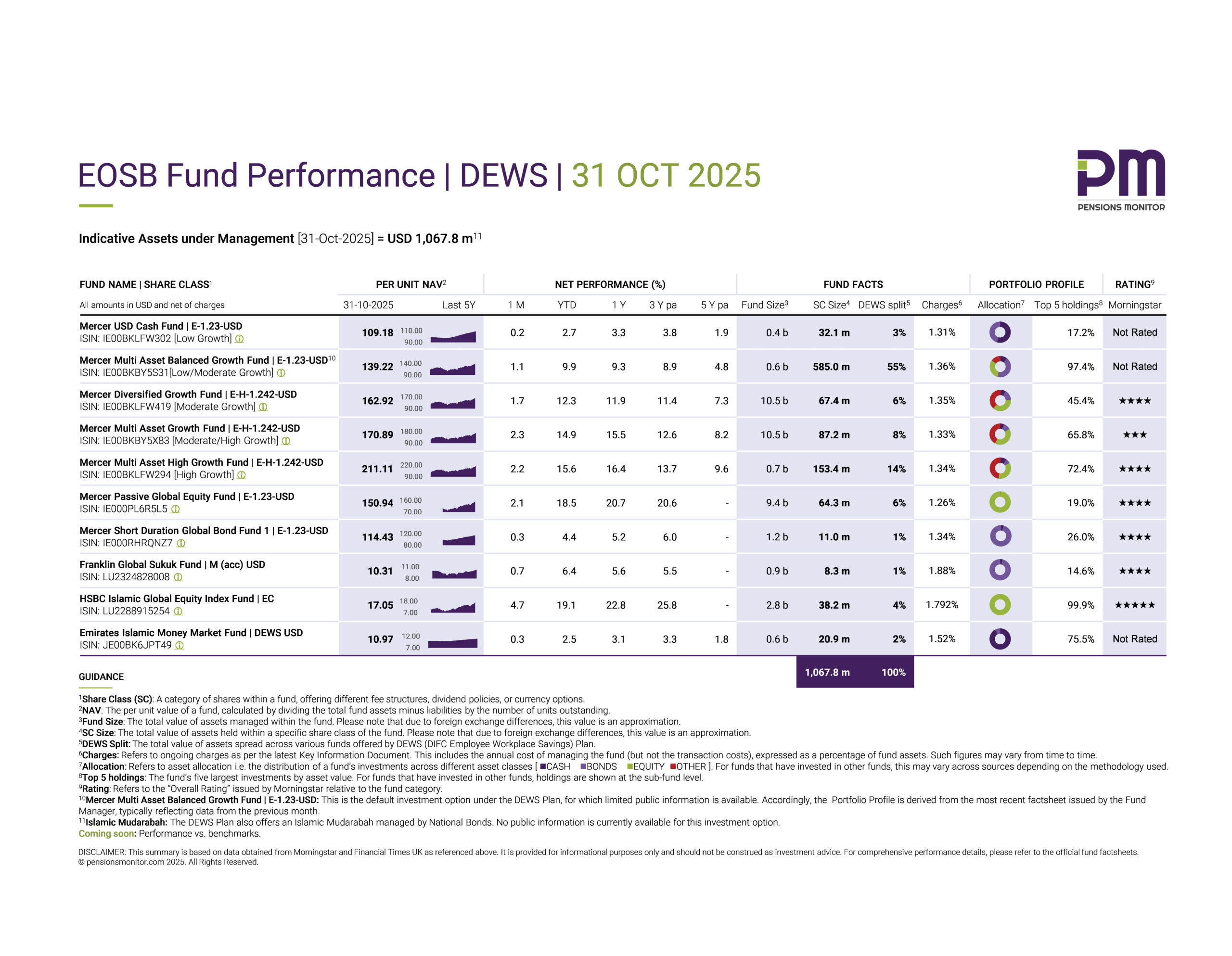

Following our review of the DEWS fund performance for October, let’s now look at how the GO SAVER funds performed during the month. For our new readers: DEWS and GO SAVER are the two official End-of-Service Benefits (EOSB) Savings Plans available to companies registered in the Dubai International Financial Centre (DIFC).

DIFC employers may choose to enrol different employees in either DEWS or GO SAVER depending on what works best for them. (We previously explained how transfers between the two plans work.)

👉 Click here to download the dashboard.

October was a strong month across the GO SAVER lineup. With the exception of the Generali Capital Protected Fund for which 2025 data is still pending (note: this is an insurance-based investment vehicle), every fund posted a positive return, including the three India equity funds that had struggled in the third quarter this year.

Indian Equity Funds: What changed?

Indian markets enjoyed a broad rebound in October as expectations of additional US rate cuts and optimism around India-US trade boosted global investor interest in India whose economic fundamentals have remained strong. Also, after three months of declines, Indian equities (especially midcaps) became cheaper, making them more attractive for investors looking to re-enter at better prices.

As such, the three India equity funds under GO SAVER finally turned positive in October and posted their first gains since June:

- UTI India Dynamic Equity: +2.9% in October, reducing the Year-to-Date (YTD) losses to -1.0%

- Goldman Sachs India Equity Portfolio: +4.4% in October, and -2.8% YTD

- Kotak India Midcap Fund: +3.0% in October, and -2.8% YTD

Now the question is: Will this rebound continue long enough for the YTD numbers to turn positive by year-end?

Other Equity Funds

GO SAVER offers two other equity-based funds with a strong US focus.

The HSBC Islamic Global Equity Index Fund climbed an impressive 4.9% in October. This fund has been riding the strength of global technology and large-cap growth stocks, and its 20.4% YTD return makes it the top performer in the entire GO SAVER range so far this year. (This fund is also available under DEWS, and we covered it in detail in last month’s article.)

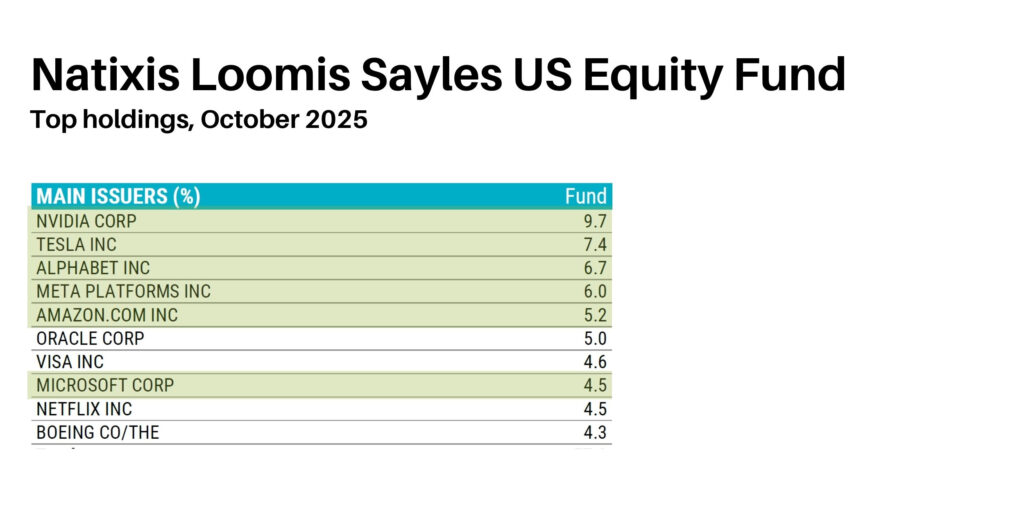

Following behind, is the Natixis Loomis Sayles US Equity Fund, up 2.1% in October and now 15.4% YTD. Looking at the top holdings of this fund, it’s clear to see that this fund has also benefited from the “Magnificent 7” stocks (excluding Apple).

Franklin Templeton’s Diversified Funds

The Franklin Diversified range also delivered strong gains in October, but their YTD performance is still catching up after a softer spell earlier in the year.

- Conservative Fund: +1.4% in October, and 4.3% YTD

- Balanced Fund: +2.1% in October, and 5.6% YTD

- Dynamic Fund: +2.7% in October, and 6.6% YTD

How does this compare with the balanced funds under DEWS?

Pensions Monitor will soon publish a comparative analysis between the two plans, comparing funds by risk class. Stay tuned!

Fixed Income and Money Market Funds

On the bond and income side, all funds gained.

The Mashreq Al Islami Income Fund (Sukuk) returned 1.9%, while global corporate bond funds from PIMCO and Schroders posted modest but positive results. The Franklin High Yield Fund returned +0.4% in October and is now +7.3% YTD.

And for the most conservative investors, the Fidelity USD Cash Fund delivered another quiet but positive month at +0.3%, bringing its YTD return to 3.6%.

Closing thoughts

Overall, October was a very good month for GO SAVER members. We saw a broad-based recovery across almost all asset classes. Tech driven equity funds motored ahead, the Indian funds finally reversed their losing streak, and the balanced and fixed income funds continued to notch up steady gains.

Will this trend continue into the final stretch of 2025?

In the first two weeks of November, there has been some turbulence in the tech stocks as many investors are now questioning whether the massive investment in Artificial Intelligence (AI) infrastructure will eventually pay off. Some analysts have been drawing parallels to the “Dot-Com” boom of 25 years ago, yet some have faith in the transformative potential of AI. We’ll cover more on this next month.

In the shorter term, much more volatility can be expected from another source: US trade policy. We’ve clearly seen the effect of this with the Indian funds. Optimism and positive sentiment can nudge a whole market by several percentage points in a month. And the opposite can be true too, as we saw earlier in April this year.

For GO SAVER members, there’s also the 2025 performance of the default fund (the Generali Capital Protected Fund) to watch out for. Stay tuned! We will share updates as soon as this information becomes available!

Subscribe to our free newsletter for independent, monthly updates on all EOSB savings funds across the UAE.

Disclosure Statement Issued in accordance with the UAE Securities and Commodities Authority’s Finfluencer Regulation. Article: EOSB Fund Performance | GO SAVER | 31 Oct 2025 Author: Nisha Braganza Capacity: Natural person SCA Finfluencer Registration: 012 Data sources: Morningstar, Financial Times UK and factsheets, cited in the Article Data date: 31 Oct 2025 Price time reference: NAVs used reflect end-of-day pricing as of “Data date” Publication date: 19 Nov 2025 Target audience: Employers/employees tracking EOSB Savings Schemes in the UAE Validity: 30-day period from "Data date", unless updated Nature of content The Article contains a dashboard (factual data and performance data) and accompanying commentary. Factual data includes Net Asset Value (NAV) per share, fund size, share class size, asset allocation, charges, top holdings, and ratings. These are sourced from “Data sources” and has not been modified. Performance data is calculated using a proprietary time-weighted return model, based on daily NAV movements. The model does not involve forward-looking assumptions or forecasts. Commentary is the author’s opinions and interpretations of the data and does not constitute financial advice or a recommendation to buy, sell, or invest in any fund. Comparisons between funds are based on publicly available information. These do not represent endorsements and have been drafted impartially, without bias or exaggeration. Limitations While reasonable care has been taken to ensure objectivity, balance, and clarity, the Author has relied on “Data sources” without independent verification. Accordingly, the Author does not accept responsibility for the accuracy or completeness of “Data sources”. Past performance is not indicative of future results and commentary does not represent expected outcomes. Previous Articles on the subject are available on www.pensionsmonitor.com. Conflicts of interest The Author has not received any compensation from the respective fund issuers, nor holds investments in any of the funds mentioned. No party involved in this publication has a commercial relationship with the respective fund issuers or EOSB Scheme managers. Investment advice disclaimer Investors are advised to consult with a financial advisor licensed by the UAE Securities and Commodities Authority or other relevant authority, before making investment decisions.