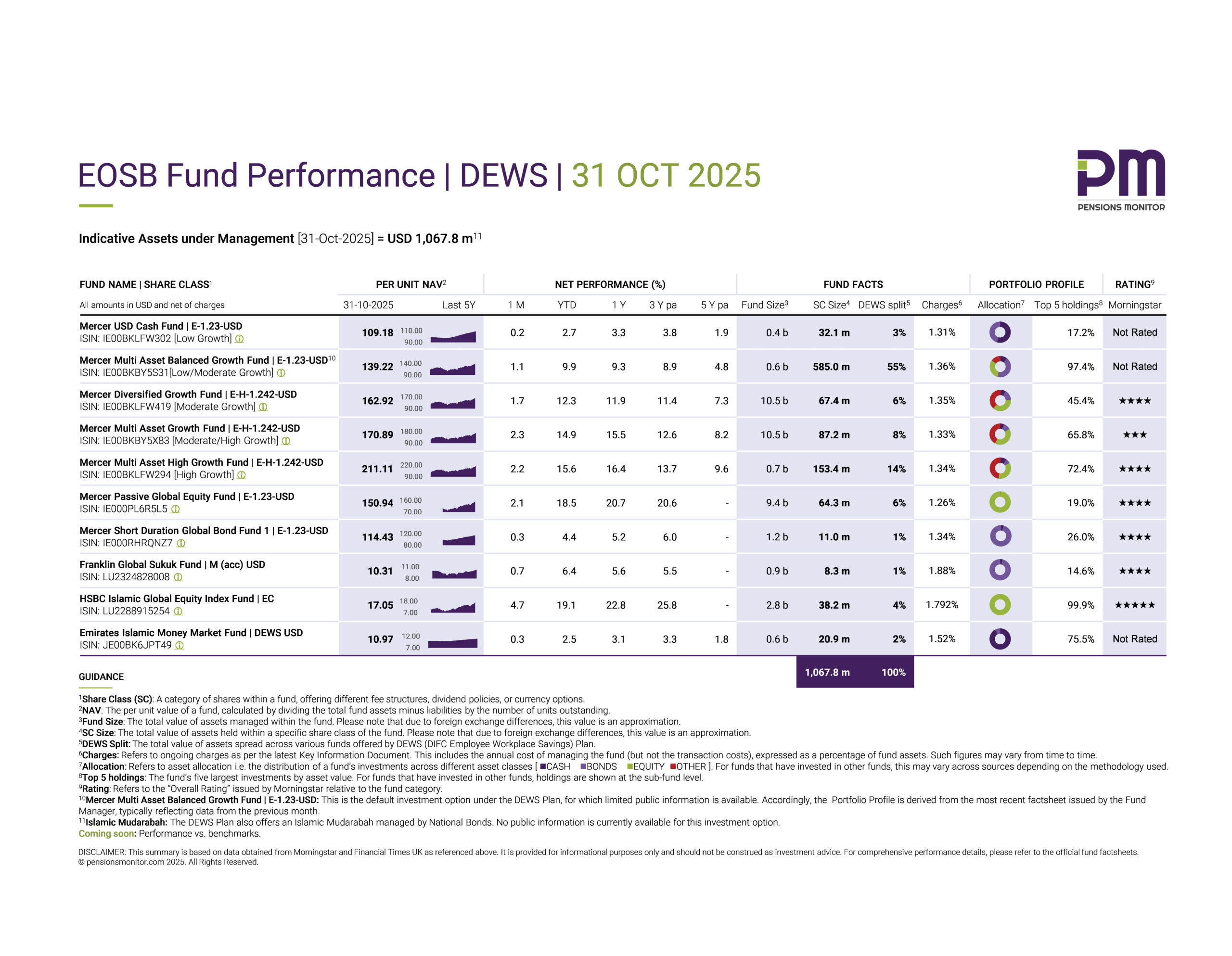

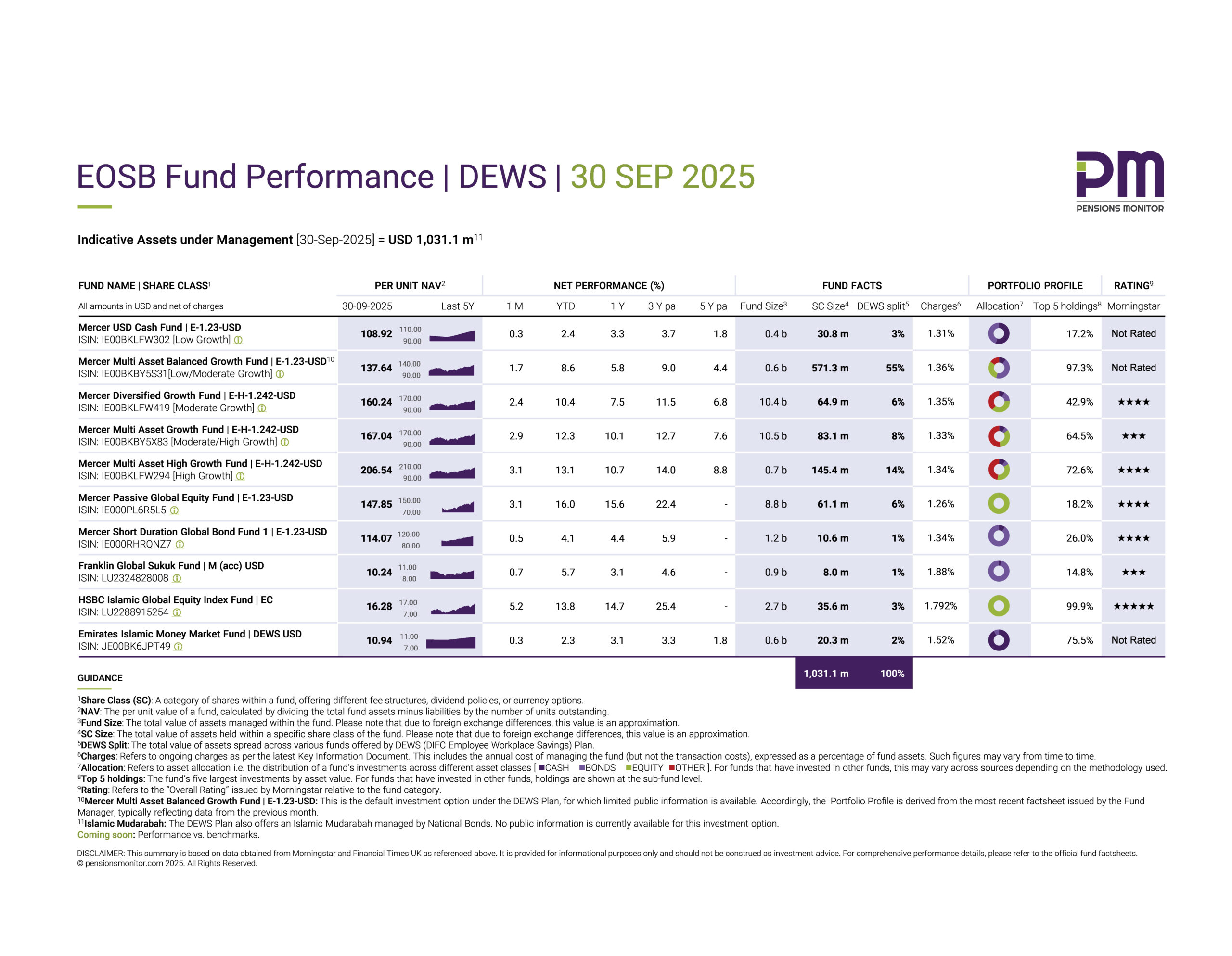

EOSB Fund Performance | DEWS | 30 SEP 2025

September turned out to be one to remember for the DIFC’s flagship savings plan, DEWS. The plan not only crossed the USD 1 billion mark in Assets under Management (AUM) – a major milestone for any savings scheme – but also delivered another solid month of fund performance.

Reaching the billion-dollar milestone is an impressive achievement, and our congratulations go out to the DEWS team – Equiom (trustee), Zurich (administrator) and Mercer (investment advisors).

👉 Click here to download the dashboard.

The billion-dollar climb

DEWS was launched in 2020 when the transition from the gratuity system to a structured savings scheme was mandated in the DIFC. For five years, DEWS remained the only EOSB savings plan available in the DIFC, allowing it to grow steadily through increasing employer and employee participation, accumulating contributions and of course, strong investment performance over time. A further boost came in 2023, when Dubai Government entities started to enrol their expatriate employees into the Plan. This segment accounted for about one-fifth of DEWS membership by the end of 2024.

Competition for DEWS arrived only this year, when GO SAVER launched in January 2025, giving DIFC employers their first alternative workplace savings option. (Note: The transfer procedures were recently agreed and tested. We explained the steps in a recent article). Competition, of course, is healthy. And it means both Plans will need to innovate, improve returns, enhance customer service, IT platforms, and – perhaps, most importantly – rethink fees.

With AUM now at ten figures, total fee revenues for the DEWS ecosystem have grown substantially. As in other markets, as savings schemes grow in size, the cost of administration per member typically falls – creating natural pressure to reduce charges. In the UK, for instance, where workplace pension schemes are many times larger in scale, annual plan charges are capped at 0.75% of AUM. For DEWS, the fees remain around 1.35%. It will be interesting to see if this will be reduced in due course, for the benefit of its members.

For now, let’s take stock of DEWS’ September fund performance and it’s a strong showing once again.

September’s results

Equity-based funds: Up, up and away?

Equity-based funds once again led the charge. These are the funds that primarily invest in company shares and tend to move with global stock markets. There are two such funds offered under DEWS:

- Mercer Passive Global Equity Fund gained 3.1% in September, bringing its year-to-date (YTD) return to 16.0%.

- HSBC Islamic Global Equity Index Fund gained 5.2%, with 13.8% YTD.

For DEWS savers invested in these funds, this means solid double-digit gains this year despite the rough start to 2025. So, patience through the early-2025 volatility when these two funds tanked -2.5% and -7.5% in Q1 2025 has paid off handsomely. These two funds are heavily invested in the technology sector and are so far, the winners this year, beating all the other funds on the panel in terms of their performance.

Bond-based funds: Slow and steady

Bond funds, meanwhile, continued to deliver steady, if quieter, progress. These are funds that invest in bonds mostly. There are two such funds under DEWS:

- Mercer Short Duration Global Bond Fund rose 0.5% in September, for a 4.1% YTD gain.

- Franklin Global Sukuk Fund did slightly better at 0.7% in September and 5.7% YTD.

Both are dependable, solid funds giving some security and some return, although in comparison with the pure equity funds the difference in returns is significant.

Balanced Funds: The best of both worlds?

And sitting between the equity-based and bond-based funds, the balanced funds performed just as their name suggests – offering growth without sleepless nights. Balanced funds invest in a mix of underlying securities: shares in companies, bonds, money market, and other commodities.

There are four such balanced funds offered under DEWS with varying levels of risk and growth potential. All four funds have delivered a solid YTD performance.

For instance, the DEWS default fund that is designed for low-moderate growth, Mercer Multi-Asset Balanced Growth, returned 1.7% in September and 8.6% YTD, while high growth (high risk) option – Mercer Multi-Asset High Growth climbed to 13.1% YTD.

There is one more balanced investment option offered under DEWS which is Shariah-compliant. This is the National Bonds Islamic Mudarabah that was introduced to the DEWS panel in May 2024 for which there is still no public information (see here for further details). We look forward to share more information on the performance of this investment option as soon as it becomes available.

Our thoughts

DEWS’ billion-dollar milestone is a big achievement – not just for the DIFC, but also for the rest of the UAE. It’s a good example that shows how regulated and professionally managed savings schemes work, and how savings compound over time.

We are sure that UAE mainland employers will gladly take note of this development, as the UAE national scheme (regulated by MOHRE and SCA) is being introduced. Of course, the UAE national savings scheme is still voluntary, but that may change soon.

So, what’s next for DEWS? And how big can DEWS become? There are several factors in play now – how effectively DEWS retains employers now that competition has entered, whether fees adjust to reflect its growing scale, and how investment performance holds up in a volatile global market. We at Pensions Monitor, see this a classic case of how scale and competition can create ever more success for the benefit of employees. We will analyse the outlook in an upcoming article. Stay tuned!

Coming up next

Our review of the performance of the rival plan, GO SAVER. Subscribe to our free newsletter for the latest on EOSB in the UAE.

Disclosure Statement Issued in accordance with the UAE Securities and Commodities Authority’s Finfluencer Regulation. Article: EOSB Fund Performance | DEWS | 30 Sep 2025 Author: Nisha Braganza Capacity: Natural person SCA Finfluencer Registration: 012 Data sources: Morningstar, Financial Times UK and factsheets, cited in the Article Data date: 30 Sep 2025 Price time reference: NAVs used reflect end-of-day pricing as of “Data date” Publication date: 13 Oct 2025 Target audience: Employers/employees tracking EOSB Savings Schemes in the UAE Validity: 30-day period from "Data date", unless updated Nature of content The Article contains a dashboard (factual data and performance data) and accompanying commentary. Factual data includes Net Asset Value (NAV) per share, fund size, share class size, asset allocation, charges, top holdings, and ratings. These are sourced from “Data sources” and has not been modified. Performance data is calculated using a proprietary time-weighted return model, based on daily NAV movements. The model does not involve forward-looking assumptions or forecasts. Commentary is the author’s opinions and interpretations of the data and does not constitute financial advice or a recommendation to buy, sell, or invest in any fund. Comparisons between funds are based on publicly available information. These do not represent endorsements and have been drafted impartially, without bias or exaggeration. Limitations While reasonable care has been taken to ensure objectivity, balance, and clarity, the Author has relied on “Data sources” without independent verification. Accordingly, the Author does not accept responsibility for the accuracy or completeness of “Data sources”. Past performance is not indicative of future results and commentary does not represent expected outcomes. Previous Articles on the subject are available on www.pensionsmonitor.com. Conflicts of interest The Author has not received any compensation from the respective fund issuers, nor holds investments in any of the funds mentioned. No party involved in this publication has a commercial relationship with the respective fund issuers or EOSB Scheme managers. Investment advice disclaimer Investors are advised to consult with a financial advisor licensed by the UAE Securities and Commodities Authority or other relevant authority, before making investment decisions.