Global markets during April 2025

Global equities

On 2 April 2025, United States President Donald Trump held a White House Rose Garden ceremony where he announced what he called a “reciprocal tariff” strategy. Subsequently, the worldwide stock markets took fright in dramatic fashion: For example, the Nikkei index shed almost 10%, as did the FTSE (-8%) and the S&P 500 dropped by 13%.

On 9 April 2025, President Donald Trump then announced a 90-day pause on most “reciprocal” tariffs, except for China. As a result, global stock indices started to climb back, and by 30 April they largely arrived at the levels of 31 March, within a 1% range.

As a result, despite the rollercoaster within the month of April, the overall 1-month performance remained quite flat.

Global bonds

The impact of Trump’s “reciprocal tariff” strategy on the global bonds has also been dramatic. During March we have seen yields rise (as bond prices fell), as investors were dumping their holdings in anticipation of a trade war. This trend was reversed in April, when yields started to fall again (as bond prices rose). For example, the Italian 10-year benchmark bond yield rose from 3.6% to 4% between January and March, and during April it went back to 3.6%.

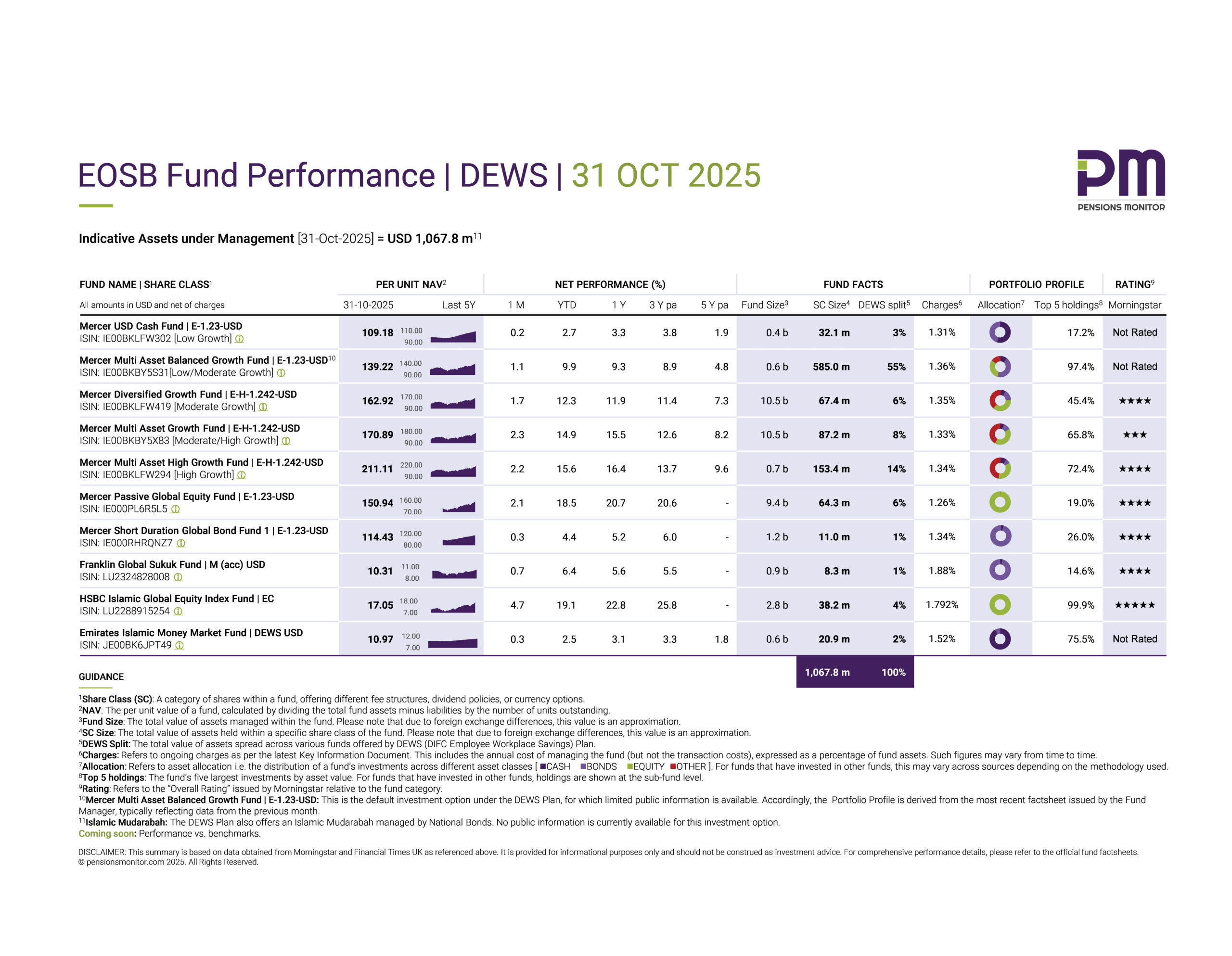

EOSB Fund Performance | DEWS | 30 April 2025

👉 Click here to download the dashboard.

So, how have the DEWS funds held up in this market turmoil?

Let’s first have a look at the funds that have a high proportion of equity:

- HSBC Islamic Global Equity Index Fund: Between 1 January and 31 March, the net performance of this fund was -7.5%. By 30 April, the net performance of the first four months in the year turned to -7.8%.

- Mercer Passive Global Equity Fund: The net performance of -2.5% for the first 3 months improved to -1.7% for the first 4 months.

- Mercer Multi-Asset High Growth Fund: -1.2% for the first 3 months improved to -0.4% for the first 4 months.

- Mercer Multi-Asset Growth Fund: -0.9% for the first 3 months improved to -0.3% for the first 4 months.

In other words, all funds in this category improved their performance from Q1 2025 to YTD April 2025, with the exception of the HSBC Islamic Global Equity fund.

How about the funds with a high proportion of bonds?

Good news. They have improved their YTD performance, for example:

- Mercer Short Duration Global Bond Fund: YTD net performance improved from 1.2% to 1.6%.

- Franklin Global Sukuk Fund: YTD net performance improved from 1.9% to 2.2%.

And what about the cash and money market funds?

As expected for very short-term assets earning interest or a profit share, relentless compound growth continues:

- Mercer USD Cash Fund: YTD net performance grew from 0.8% to 1.0%.

- Emirates Islamic Money Market Fund: YTD net performance grew from 0.7% to 1.0%.

This shows again that whilst cash and money market funds do not provide spectacular returns over the long run – in times of market turmoil, they are a robust and generally safe alternative.

And finally, how has the DEWS default fund performed?

The Mercer Multi Asset Balanced Growth Fund may be of particular interest to a majority of DEWS Plan participants, as Pensions Monitor research has shown that approximately 57% of plan savings are invested in this fund.

Well, it’s good news again: This fund increased its YTD performance from 0.7% to 1.5%.

Summary and outlook

In summary, after the negative first quarter performance, by and large, fund performance has improved (with some exceptions), mirroring the performance of the global markets.

What can we expect for the coming months?

That is, of course, very difficult to predict. However, perhaps it’s worth thinking in terms of the following scenarios:

- In case Trump re-applies the tariffs fully after the 90 days pause, we can expect a further bloodbath in July/August. In April, the stock markets dropped by 10% or more – it is not unreasonable to assume a similar movement in case the tariffs are (re) introduced after the 90 days pause.

- In case the US does not apply these tariffs as announced, then we can, all else being equal, expect a further calming of the market, perhaps with growth and improvement.

These two scenarios may well describe a “pessimistic” and an “optimistic” scenario, and perhaps the reality may fall somewhere in between. Depending on which scenario you believe is more probable, maybe now would be a good time to review your portfolio allocation and re-balance your portfolio in line with your risk appetite and overall market expectation.