DEWS (Dubai Employee Workplace Savings), the first official End-of-Service Benefits (EOSB) Savings Scheme in the Dubai International Financial Center (DIFC), has now been operational for over five years. During this time, employers in the DIFC have been making regular contributions on behalf of their employees into investment funds, chosen by employees.

Last week, we at Pensions Monitor released our first EOSB Fund Performance dashboard on DEWS as at 31 March 2025. The dashboard includes five-year net fund performance and other useful metrics across the full suite of available investment options. DEWS currently offers 10 funds, plus an 11th option – the Islamic Mudarabah from National Bonds that was included in May 2024.

👉 Click here to view and download the dashboard.

We at Pensions Monitor were curious: How are DEWS plan members choosing to invest their savings?

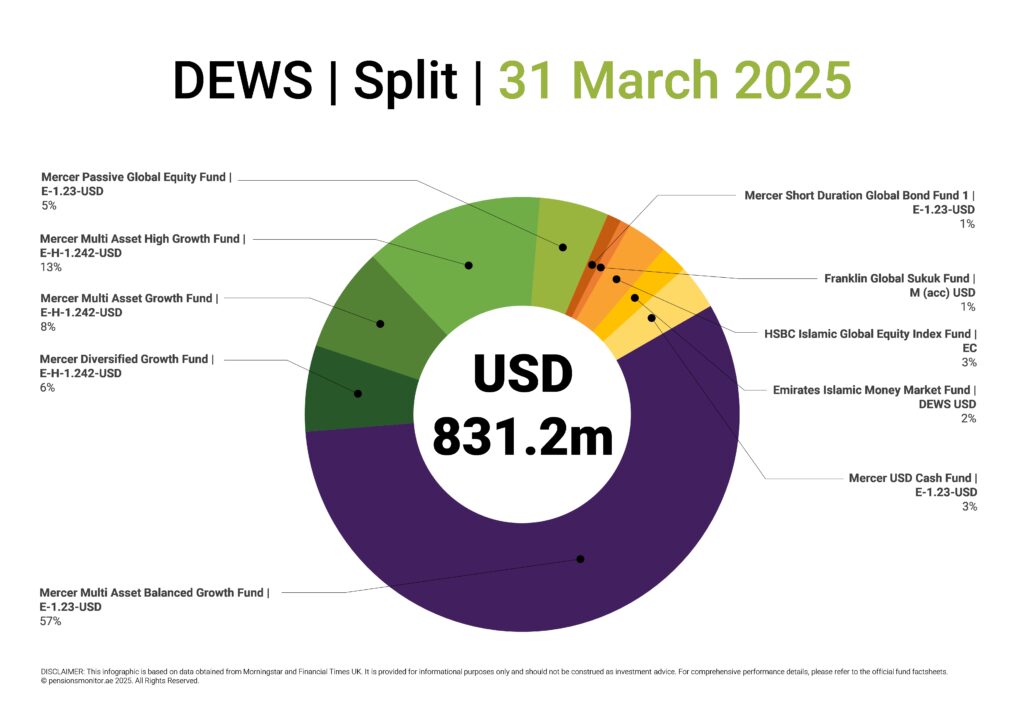

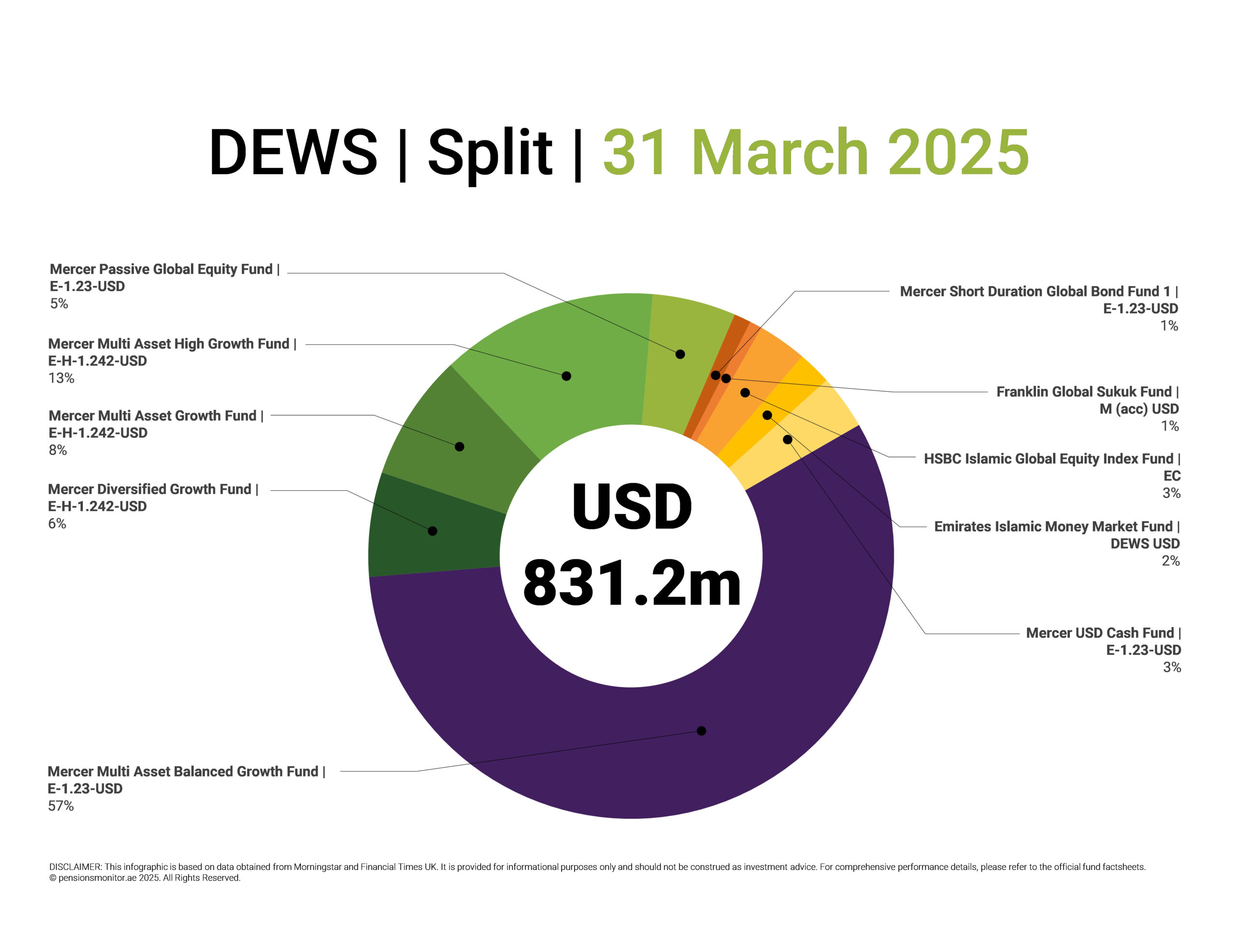

While this analysis wasn’t entirely straightforward, we were able to derive estimates using publicly available share class data for each DEWS fund. It’s worth noting that no data is publicly available for the National Bonds Islamic Mudarabah fund, so our breakdown is indicative only.

Here’s what we found, and the results are eye-opening.

The power of the default

The main take-away is that ~57% of all DEWS savings are held in the “Mercer Multi Asset Balanced Growth Fund”, which serves as the plan’s default investment option – which carries a low-to-moderate risk profile and has delivered an average net return of 4.9% per year over the past five years.

The relatively high proportion of savings in the default fund suggests that the majority of participants are content with the default setting and choose not to actively manage or diversify their portfolio.

This observation is particularly interesting given that many DIFC employees are finance professionals. And so, it raises another interesting question: How will participants in the mainland UAE savings plans invest their contributions? With generally lower levels of financial literacy, we expect the popularity of the default option to be even more pronounced in the mainland context, once Cabinet Resolution 96 of 2023 is fully implemented.

Funds with a higher equity component prove popular

Apart from the default option, it appears that higher-risk funds i.e., those with a higher equity component also enjoy some popularity, despite their relatively modest 3-star rating by Morningstar. These include:

- Mercer Multi Asset High Growth Fund (13%)

- Mercer Multi Asset Growth Fund (8%)

- Mercer Diversified Growth Fund (6%)

- Mercer Passive Global Equity Fund (5%)

Together, these funds account for about one-third (33%) of total DEWS assets.

Shariah Complaint options: A small but important niche

DEWS also offers four Shariah Compliant investment options:

- Franklin Global Sukuk Fund

- HSBC Islamic Global Equity Index

- Emirates Islamic Money Market Fund

- National Bonds Islamic Mudarabah (no information publicly available).

Based on the three funds for which data is available, Shariah-compliant investments represent ~6% of total assets. While this is a small slice of the overall pie, it is an important niche given that these funds accommodate plan participants with religious preferences. Again, it will be interesting to see how this develops further, and how this will play out in mainland UAE.

Conclusion

The way DEWS members allocate their savings provides an interesting view into investor behaviour in the UAE, even among financially literate professionals.

The high proportion of savings (~57%) in the default fund of DEWS is striking. We cannot quite fathom why this may be the case—perhaps due to trust in the plan design, inertia, or a lack of time or expertise.

As one would expect, funds with higher equity component prove to be popular (~33%), as they offer the best opportunity for long-term growth. However, during market turmoil, it is exactly these funds that are most volatile.

As the UAE prepares to expand EOSB savings beyond the DIFC, it is important for fund managers and policymakers to understand these behavioural patterns. The default option will likely be where most people’s money ends up, so it’s important to make sure that the default option is well-designed. Equally important, is also to educate employees on their investment choices. This can lead to better outcomes and more trust in the system.

Pensions Monitor will continue to monitor all EOSB Savings Schemes. Do sign up for our free newsletter to stay updated.