Ras Al Khaimah Economic Zone (RAKEZ) has entered into a strategic partnership with PraxisIFM Trust Limited (Praxis), an established provider of pension solutions, and fintech company Equevu Ltd (Equevu), to introduce the Middle East Workplace Savings Scheme (MEWSS) to its business community.

The memorandum of understanding (MOU), reportedly signed last week, aims to encourage the approximately 30,000 companies registered with RAKEZ to adopt a workplace savings scheme to promote the financial wellness of their employees, on a voluntary basis. Pensions Monitor has been made to understand that MEWSS is currently the only workplace savings scheme endorsed by RAKEZ. However, the scheme is not mandatory, and companies may also choose alternative solutions.

About MEWSS

MEWSS is a voluntary workplace savings scheme that covers two core elements:

End-of-Service Benefits (EOSB) gratuity funding and management

The scheme essentially enables employers to fund and manage their EOSB gratuity liability in a segregated trust account which earns a return over time. When employees leave the company, MEWSS pays the respective amount back to the company, which is then responsible for paying the employees directly in line with Labour Law legislation. So, while MEWSS helps companies save for their liabilities, companies remain liable to fulfil their EOSB obligations when employees leave.

Employee savings

MEWSS also gives employees the option to pay monthly voluntary contributions for additional savings through payroll deduction only. This can be co-funded by the employer, if they wish. Employees can adjust their contribution every three months via the MEWSS platform. When employees leave their job, their savings with MEWSS can be left in place or withdrawn.

Scheme structure

The scheme is managed by Praxis as the trustee and administrator, with Equevu providing the technology platform. Both Praxis and Equevu are registered with Abu Dhabi Global Markets (ADGM) since 2016 and 2022 respectively. Praxis is part of the Praxis Group, that has been providing pensions solutions for over 50 years to more than 10,000 members with USD 1.8bn+ of assets under administration as at December 31, 2023. In the UAE, Praxis is regulated by the Financial Services Regulatory Authority (FSRA) in ADGM and has been offering voluntary corporate pension services in the UAE since 2016. No information on the member count or assets under administration in the UAE have been disclosed to us.

Investment options

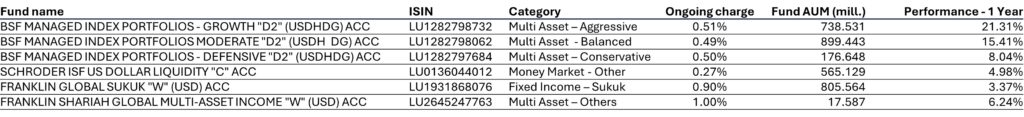

Launched in 2023, MEWSS offers top-tier investment funds managed by renowned global firms, including BlackRock, Franklin Templeton, and Schroders. The scheme provides six investment options as listed below. MEWSS reportedly only offers investment funds that are deemed suitable for retail investors and does not add any commissions or retrocessions to the investments. Note: The funds available under MEWSS are subject to ongoing review and could change.

Takeaway

It is encouraging to see freezones taking steps to promote workplace savings schemes, shortly after the introduction of Cabinet Resolution 96/2023 (mainland EOSB Savings scheme). Earlier this year, ADGM introduced workplace savings schemes as an alternative to the gratuity system, effective from April 1, 2025 (see previous article).

However, while RAKEZ has endorsed MEWSS, it has not made the scheme mandatory for its business community. This differs from the approach taken by Dubai International Financial Centre (DIFC), which made it compulsory for all companies to register with an approved plan (DEWS or GO SAVER).

Companies should also note that MEWSS on its own, does not fulfill an employer’s obligation towards EOSB gratuity liabilities and employers are still required to pay EOSB gratuity to their employees, regardless of whether they enroll in MEWSS.

Additionally, it is anticipated that the mainland EOSB Savings scheme will become mandatory in the future, and it remains uncertain whether MEWSS will be approved by the regulators (MoHRE and SCA) of the mainland scheme by that time.

Pensions Monitor will be discussing more on “voluntary” workplace savings schemes in our upcoming articles. Sign up for our free newsletter for updates on the topic and all the latest EOSB news.

If you or your company have questions or comments on the subject, please reach out to us at info@pensionsmonitor.com.