Lunate Capital LLC (‘Lunate’), one of the four approved providers for the UAE’s End-of-Service Benefits (EOSB) Savings Scheme, recently announced the launch of its EOSB Savings plan, branded as Ghaf Benefits. Ghaf Benefits, is named after the drought-tolerant Ghaf tree which is also the national tree of the UAE and is a registered trademark for Lunate End-of-Service-Benefits.

Ghaf Benefits is the first EOSB Savings plan to feature risk-based funds alongside the capital guarantee option for UAE mainland EOSB savings. The plan offers six sub-funds with conservative (4) and balanced (2) risk profiles and includes Shariah-compliant options.

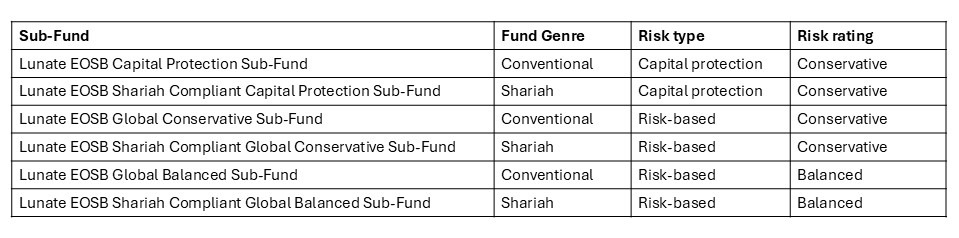

Sub-Funds of Ghaf Benefits

Below is the list of sub-funds as disclosed by Securities and Commodities Authority (‘SCA’) as at 11 February 2025:

Overview of the sub-funds

Based on public information, the Capital Protection Sub-Funds have been designed to provide a stable rate of return over time with minimal risk, ideal for investors seeking to preserve capital although the capital protection mechanism has not yet been disclosed. Similarly, the Global Conservative Sub-Funds are said to deliver consistent returns with minimal risk.

Now, the details regarding the specific asset classes of the sub-funds have also not been disclosed. However, taking cues from the names of the sub-funds, it is likely that these “minimal risk” sub-funds differ in terms of geographic diversification and the capital protection element. The Capital Protection Sub-Funds, we understand, are required to invest 100% of its assets locally, primarily in money market instruments and government-rated fixed-income securities and offer some form of capital protection. The Global Conversative Sub-Fund will probably maintain a similar risk profile but offer a broader geographical exposure without capital protection.

There are two more sub-funds, Global Balanced Sub-Funds which is intended for investors who are willing to take on a moderate level of risk in exchange for potential long-term growth.

Currently, the Ghaf Benefits plan does not offer any dynamic (high-risk) sub-funds and it is interesting to note how the offerings of the mainland plans compare with those available in the DIFC which allows for a best-of-breed selection. You can find a comprehensive list of EOSB Savings Funds in the UAE in Pensions Monitor’s EOSB fund directory.

Service providers

In terms of operations, the sub-funds of Ghaf Benefits will be managed and administered by Ghaf Benefits Capital LLC while details of the other service providers including the custodian bank, plan administrator and service portal operator are expected to be revealed soon. Pensions Monitor will share this information with our readership as soon as it becomes available.

Sign up for our free newsletter for the latest updates on End-of-Service Benefits.